PREVIOUS TRADING DAY EVENTS – 17 May 2023

Announcements:

Australia’s hot labour market might be cooling. The policymakers might take this as a signal that their last surprise rate hike to 3.85% was enough and now they consider a pause next month.

“We expect to see a gradual softening in labour market conditions over 2023 as the impact of interest rate increases to date start to bite,” said Sean Langcake, head of macroeconomic forecasting for Oxford Economics Australia.

“Whether today’s data are the start of that process or just typical volatility will be a key question at the upcoming RBA meeting. At the margin, these data weaken the case for another rate hike,” Langcake added.

The Wage Price Index q/q figure was released yesterday. The seasonally adjusted WPI rose 0.8% this quarter and 3.7% over the year. The RBA believes this is important.

“Today’s data and WPI yesterday together reduce the risk the RBA would opt to raise rates again as soon as June and together are helpful at the margin on the skew of risks around the RBA’s inflation outlook,” said Ivan Colhoun, an economist at National Bank of Australia.

“NAB’s view is that there will likely be at least one further rate increase, but we remain close to the peak of this interest rate cycle.”

Source:

“I’m confident that we’ll get the agreement on the budget and that America will not default,” Biden said Wednesday at the White House, shortly before departing to Hiroshima, Japan for a Group of Seven leaders summit.

Biden’s decision on leaving in such critical moments has been criticised by McCarthy and other Republican lawmakers

“Mr President, stop hiding, stop travelling,” McCarthy said.

The U.S. president announced that he is cancelling planned stops in Australia and Papua New Guinea and returning back for continuing negotiations by the beginning of next week. In the meantime, he said he will remain in close contact with the speaker and negotiators as he travels overseas.

“We’re going to continue these discussions with congressional leaders in the coming days until we reach an agreement,” Biden said.

The White House negotiators met Tuesday evening with McCarthy’s representatives and are slated to resume negotiations on Wednesday.

______________________________________________________________________

Summary Daily Moves – Winners vs Losers (17 May 2023)

- JPY experienced strong depreciation against other currencies yesterday pushing pairs, with JPY as quote currency, sharply upwards. AUDJPY led with a 1.02% change.

- This week so far the AUDJPY is leading with a 1.72% price change and is also the month’s top gainer with a 1.84% change overall.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (17 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, Australia’s Wage price index figure was released. The change in the price businesses and the government pay for labour, excluding bonuses, was lower than expected. WPI rose 0.8% this quarter and 3.7% over the year. The AUD was affected but not much with depreciation at that time before retracing soon.

- Morning – Day Session (European)

Final CPI figures for the Eurozone were released at 12:00. They were as expected and no significant intraday shocks took place, nor high volatility.

At 17:30, the Crude oil (WTI) inventory figures were released. Analysts were anticipating a negative change, -1.3M, however, the figure was positive and in fact 5M more than the previous 3M in inventories. The market did not react much to the news at that time, with just 70 cents downward movement before reversing. Oil moved significantly upwards eventually yesterday.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

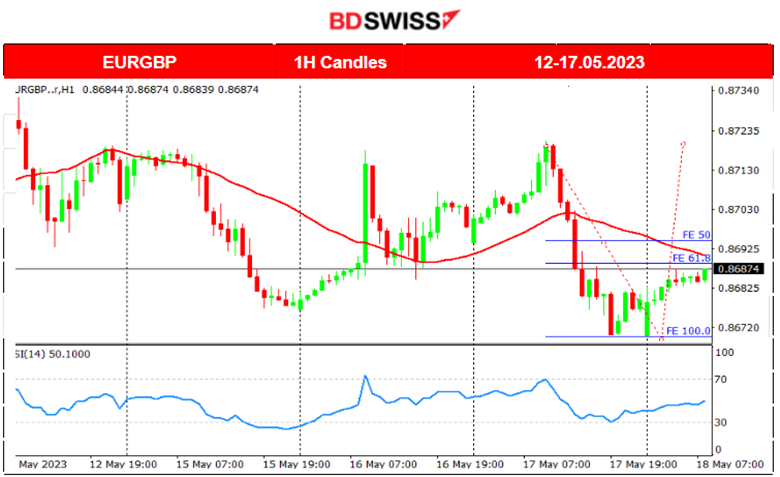

EURGBP (16.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Most pairs experienced low volatility and sideways movement around the 30-period MA except the pairs with JPY as quote currency since the JPY depreciated yesterday. EURGBP experienced high volatility with a significant reversal though that was hard not to mention. During the European session, the price reversed moving downwards, crossing the 30-period MA and breaking support levels as it was moving further down. It found strong support eventually at 0.86700 and started the retracement back to the mean.

Trading Opportunities

Sometimes it is quite difficult to find the strong support level, or resistance level that brings an end to the rapid or sharp movement of the pair (100 FE). However, that is the key to catching retracements with the proper use of the Fibonacci Expansion tool as depicted. The pair reversed to 61.8 FE.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index continues to move upwards for days and above the 30-period MA confirming an upward short-term trend. I say short-term because we have experienced many reversals for all indices accompanied by high volatility. The market can reverse at any time since there is no significant news that forms expectations of more upward movement for U.S. stocks.

Trading Opportunities

The index jumped yesterday more than 140 USD and there is a possibility of a retracement today, the 18th of May.

Related analysis in TradingView BDSwiss Academy:

https://www.tradingview.com/chart/NAS100/8EalLp65-NAS100-Early-Reverse-18-05-2023/

______________________________________________________________________

COMMODITIES MARKETS MONITOR

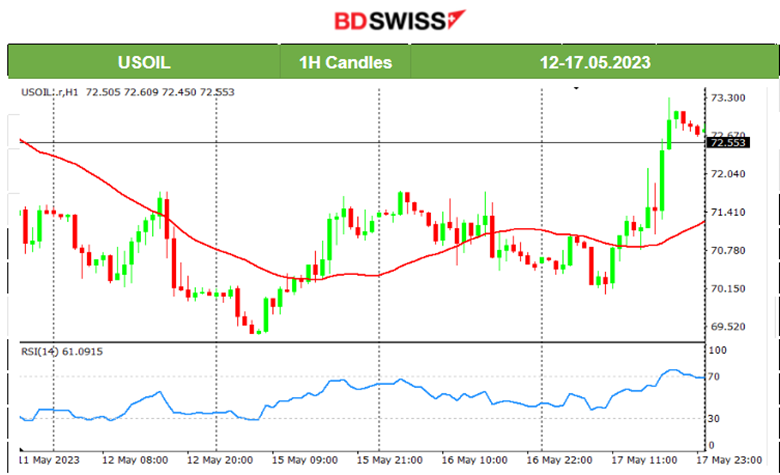

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was experiencing higher-than-normal volatility on a sideways path. Yesterday, it deviated a lot on the upside. After breaking the important resistance level 71.70 USD, it continued moving nearly 1.5 USD more upwards. It eventually found resistance again with some retracement taking place but not significant.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold continues its downward movement below the 30-period MA signalling that it is experiencing a downward trend. This might be short. Recent news does not support further sharp decreases. The risk-on mood of investors has turned on these days and we see stocks gaining, however, the current market conditions are more in favour of retracements or even reversals.

In addition: the RSI shows bullish divergence as Price: lower lows, RSI: Higher Lows. Even though the market retraced a bit, further upward movement is possible after the market breaks some important resistance levels near 1986 USD.

______________________________________________________________

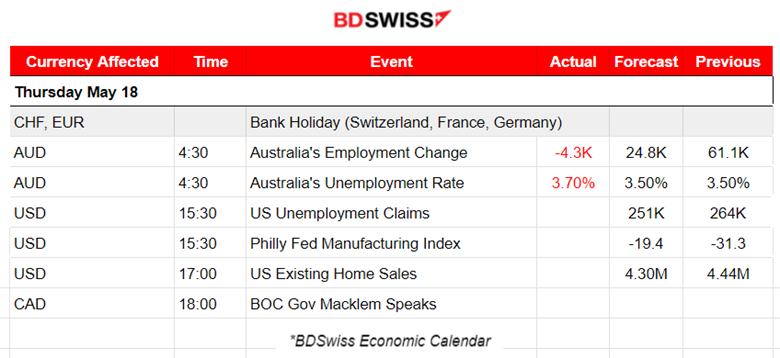

News Reports Monitor – Today Trading Day (18 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, Australia’s Employment change and unemployment rate announcements were released. Employment change turned out negative while the unemployment rate rose unexpectedly. AUD suffered depreciation and AUDUSD dropped nearly 30 pips before retracing fully.

- Morning – Day Session (European)

At 15:30, the U.S. unemployment claims figure is going to be released and probably create an intraday shock for USD pairs. Employment data are always considered important. The Fed which is trying to fight inflation by increasing borrowing costs is looking at the data to find evidence of labour market cooling. Investors react as they form expectations about future policy decisions. Economists expect lower figures this time.

The Philly Fed Manufacturing Index figure is also being released at the same time and might add to the effect.

General Verdict:

______________________________________________________________