PREVIOUS TRADING DAY EVENTS –25 Oct 2023

“While 4.35% should mark the peak in the cash rate, there is a risk it could tighten beyond that. Any easing remains a very long way off,” said Adam Boyton, head of Australian Economics at ANZ.

The third quarter inflation rise was mainly caused by fuel, rents, and electricity. Fuel prices rose 7.2% from a year ago with the conflict in the Middle East potentially set to further stoke inflationary pressures.

“The RBA’s August forecast embedded a hope that they were already making in-roads into that demand-driven domestic inflation problem,” said Taylor Nugent, a senior economist at NAB. “The key implication of today’s data is that that hope was misplaced.”

Inflation in September dipped to 3.8% from 4.0% in August and it is expected to return to the 2% target by the end of 2025.

“Progress towards price stability is slow and inflationary risks have increased,” the BoC said in a statement. Among the risks cited were oil prices, which are higher than had been assumed in July, and the war in Israel and Gaza, which adds to geopolitical uncertainty, the BoC said.

______________________________________________________________________

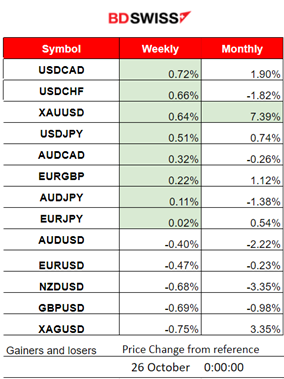

Winners and Losers

News Reports Monitor – Previous Trading Day (25 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

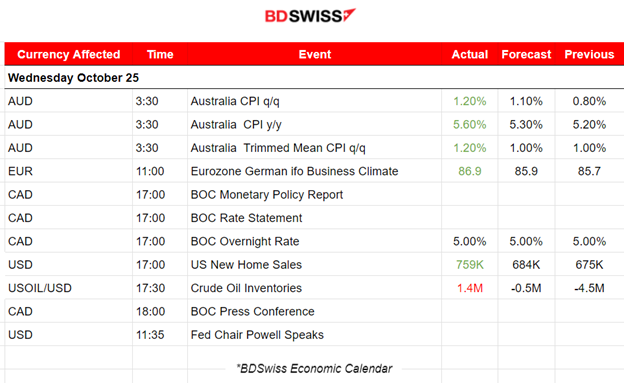

Australia’s inflation figures were reported higher than expected. The market experienced a shock with the AUD appreciating for a while but soon the effect reversed. The AUDUSD jumped 40 pips at the time of the CPI data release and it steadily moved to the downside soon after retracing back to the mean.

- Morning–Day Session (European and N. American Session)

The German Ifo business climate report showed improvement in morale, more than expected in October, following five consecutive months of decline. The Ifo Institute said its business climate index stood at 86.9 versus the 85.9 reading forecast by analysts. No major impact was recorded affecting the EUR. Slight appreciation at that time.

The Bank of Canada decided to keep the overnight interest rate unchanged. Unexpectedly the impact in the market was minimal at the time of the release. The CAD experienced slight depreciation against other currencies but it soon faded.

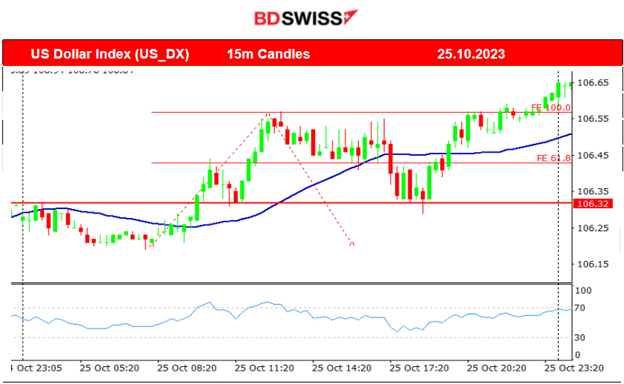

The U.S. New Home Sales figure was reported at the same time. A higher-than-expected figure of 759K showed a jump in sales that caused the USD to appreciate moderately at the time of the release.

Crude Oil inventories figures showed a positive 1.4M change, meaning more barrels were left in inventories. This could be the result of lower demand lately caused by the recent apparent geopolitical events and other factors. A less negative figure was expected coinciding with the reported figure direction of expecting more barrels in inventories.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (25.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

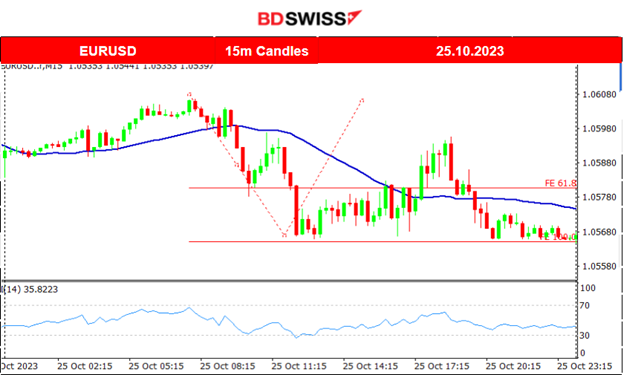

The pair started to move to the downside rapidly after the European session started until it found support at near 1.05650. After that, it soon retraced back to the mean and continued with a volatile path downwards. Apparently, it is mainly driven by the USD which experienced appreciation mostly during the trading day.

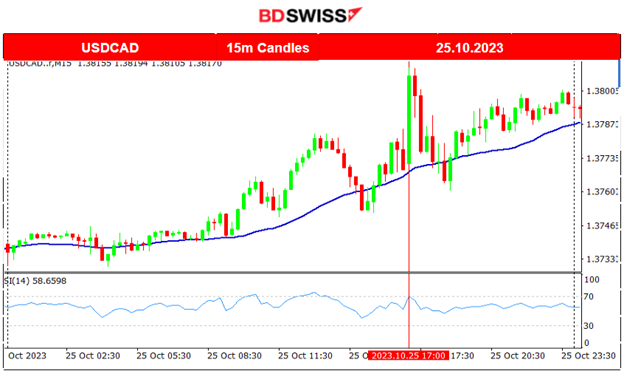

USDCAD (25.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USDCAD started to show higher levels of volatility on its way up after the European session started. It was following an intraday upward trend. At 17:00 when the BOC rate decision was announced the pair jumped near 40 pips but soon retraced back to the mean. The impact was not so great on the CAD. The USD was gaining strength and eventually, the trend resumed with the pair moving to the upside again, closing the trading day higher.

___________________________________________________________________

___________________________________________________________________

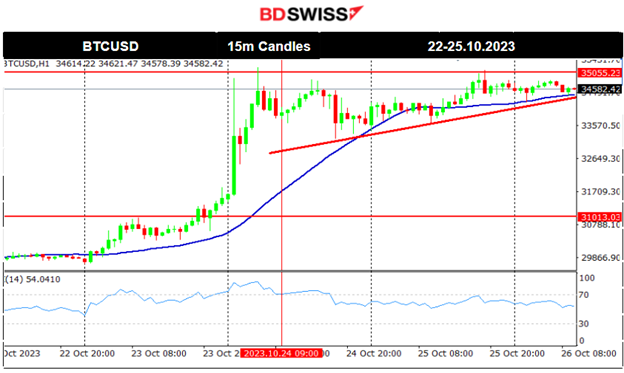

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin and several cryptocurrencies and related stocks such as Coinbase Global (COIN), Marathon Digital Holdings (MARA), Riot Platforms (RIOT) and Microstrategy (MSTR) experienced a surge in value after a U.S. appeals court ordered the Securities and Exchange Commission to review Grayscale’s application for a spot Bitcoin ETF. Bitcoin has moved significantly to the upside breaking all important resistance levels reaching even until near the level of 35,200 USD, clearly visible on the chart on the 24th Oct. That was the level at which the rapid surge in price finally ended with its price soon retracing back to the 30-period MA. Bitcoin remains in consolidation having the 35000 USD as an important resistance level. Fundamentals remain the key factors that push the price to deviate significantly. However, we see technically that the RSI is having lower highs indicating a bearish divergence. Will Bitcoin break the triangle formation to the downside? If so, will it move rapidly to lower levels? Let’s see.

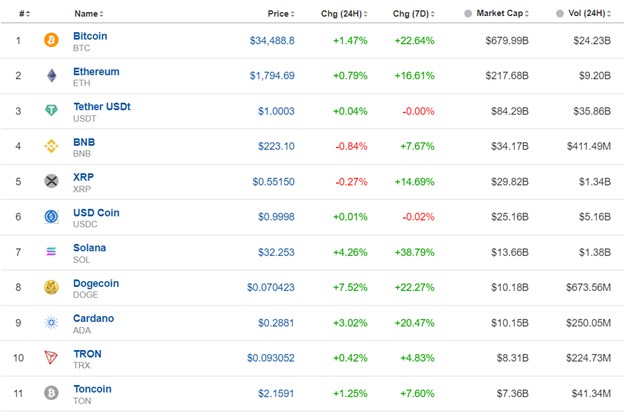

Crypto sorted by Highest Market Cap:

As per Bitcoin, the last 24 hours found crypto in a better position showing some gains. Dogecoin gained the most with 7.52% change. In the last 7 days, some crypto have gained more than 20% gains including Bitcoin, Dogecoin and Cardano. A result of Course due to the news as explained above.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A consolidation phase was interrupted yesterday as NAS100 plummeted to lower levels. The index was showing signs that the downtrend was over while it moved to the upside on the 23rd Oct, crossing the 30-period MA on its way up and remaining high. On the 25th though it moved to the downside again as fundamental factors kicked in. A probable support was broken today and remarkable is moving downwards still.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was following a clear downward trend that ended on the 25th Oct. It found support near 82.2 USD /b before it reversed. Yesterday, the price of Crude moved rapidly to the upside reversing and crossing the 30-period MA. It was a retracement from the recent long fall back to the 85 USD/b level. The retracement was in line with the indication of a bullish divergence as per the RSI’s higher lows.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of gold was moving mainly sideways with high volatility. We see big deviations from an almost flat 30-period MA. The red resistance line shows that gold broke those resistance levels moving rapidly upwards but the deviation was not great due to the significant resistance level near 1985 USD/oz that keeps the price stable. However, that resistance is broken now and we might see gold moving further to the upside.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (26 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

The ECB is going to decide on rates at 15:15. The market expects that there is not going to be any change. According to the economic data so far, the business conditions in the Eurozone worsened significantly. PMIs are showing low figures for both sectors, in the contraction area. The effects of interest rate hikes are clearly devastating for business and pausing might be the right call at this point. Fighting inflation is important, however, evaluating properly the lasting effects of the current monetary policy is crucial. EUR pairs are likely to be affected. A chance for a moderate intraday shock exists regardless of the outcome.

Weekly unemployment claims for the U.S. are going to be reported at 15:30 affecting the USD pairs. Recent figures are close to 200K and it is not expected that we will see a surprise. No major shock is expected. Durable goods orders are going to be reported at the same time.

ECB press conference at 15:45 has a chance to increase volatility levels for EUR pairs and major currency pairs.

General Verdict:

______________________________________________________________