Previous Trading Day’s Events (14 Dec 2023)

Net employment jumped remarkably by 61.5K in November from October. The unemployment rate rose to 3.9%, the highest reading since May last year, from an upwardly revised 3.8% in October.

The Federal Reserve signalling rate cuts in the year ahead

“I think from the RBA’s point of view, this is kind of where they expected it to be and I don’t think that they’ll be particularly surprised by these results,” said Cherelle Murphy, chief economist at EY Oceania. “There is certainly enough momentum for the economy to result in employment growth, but it will slow and we will see the unemployment rate rise a little.”

“We expect it to be harder to hold down the unemployment rate from here given the above dynamic in a slowing economy and when indicators of the labour market are loosening,” said Belinda Allen, an economist at the Commonwealth Bank of Australia.

While rate cut pricing was pared back slightly after the ECB and BoE meetings, the scale of the cuts priced in remains significant, with investors cheered by signs inflation is falling fast.

Eurozone inflation tumbled more than expected to 2.4% in November, while in Britain it slowed to 4.6% in October, also lower than expected. ECB president Christine Lagarde said “underlying” price pressures were moderating more than the ECB expected.

The level of rate cuts now priced for the ECB reflected a “very very gloomy” economic and inflation outlook, said Danske Bank chief analyst Piet Christiansen. “It seems quite an economic crisis scenario where you need to cut 150 basis points in one year,” he said, adding the risk is for government bonds to sell off.

“The market is looking at the real economic numbers and they see inflation coming down and the potential for lower rates,” said Gerard Fitzpatrick, head of fixed income at Russell Investments, speaking ahead of the Fed’s Wednesday meeting.

______________________________________________________________________

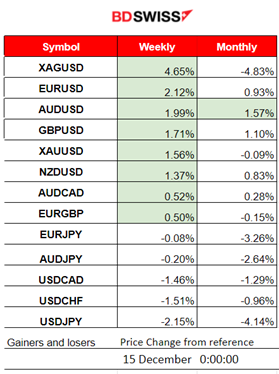

Winners vs Losers

Silver remains on the top of the winner’s list for this week with 4.65% gains followed by EURUSD having 2.12% gains. The dollar remained weakened against other currencies.

______________________________________________________________________

______________________________________________________________________

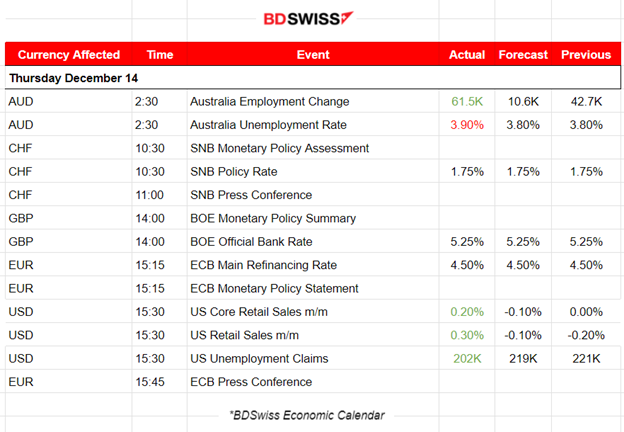

News Reports Monitor – Previous Trading Day (14 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

At 2:30, during the Asian session, Australia’s labour-related data were released showing that employment change was reported higher than expected, however, unemployment hit a 1-1/2 year high. The market reacted with steady AUD appreciation against other currencies since the report’s release.

- Morning–Day Session (European and N. American Session)

The Swiss National Bank (SNB) kept the SNB policy rate unchanged at 1.75%. Inflationary pressure has decreased slightly over the past quarter and the SNB is willing to be active in the foreign exchange market as necessary. The market reacted causing high volatility for CHF pairs, an up-down effect, keeping them close to the mean (30-period MA).

The European Central Bank (ECB) and Bank of England (BOE) also kept their interest rates steady but they are reluctant to join the views of the Fed in pivoting toward rate cuts.

BOE held its policy rate at 5.25%, as expected by all economists and markets. Policymakers stated, “monetary policy is likely to need to be restrictive for an extended period of time”. The GBP started to appreciate steadily against other assets after the announcement.

ECB kept its policy rate at 4.5% as widely expected. “The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary,” it said in a statement. There was no major impact in the market at the time of the release but during the press conference, the EUR appreciated moderately against other currencies.

At 15:30 the Retail Sales and Unemployment claims figures for the U.S. were released. The report showed that retail sales performed much better than expected in November, with positive instead of the expected negative changes, suggesting consumers do not hold back from spending despite current economic conditions. The labour market also remains tight. Jobless claims were reported lower than expected but again close to the 200K mark.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

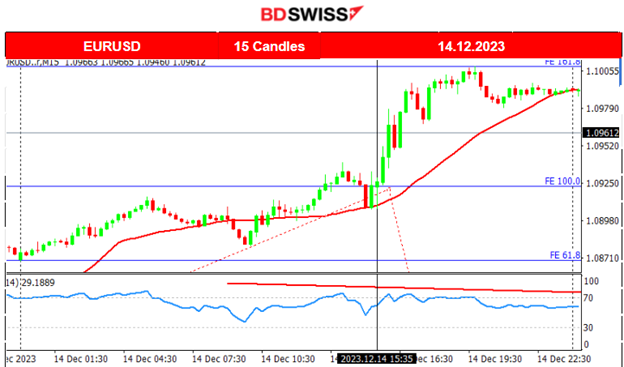

EURUSD (14.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Recent FOMC statements generated expectations about lower future interest rates causing the USD to depreciate heavily, thus the pair experienced a significant movement to the upside recently. Yesterday after 15:30 volatility levels increased with the USD experiencing depreciation while the EUR experienced appreciation against other currencies, pushing the pair to climb further closing the trading day higher.

4-Day Chart Summary

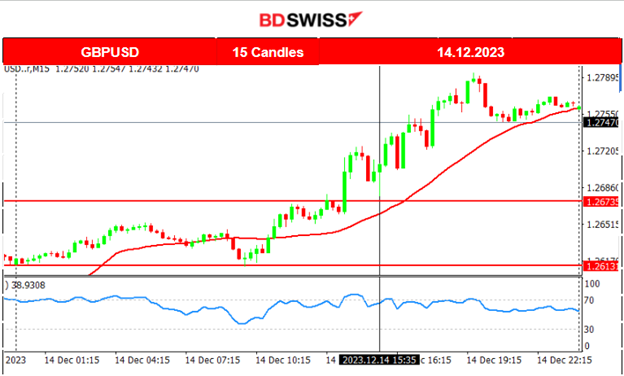

GBPUSD (14.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The BOE decision to keep the OBR steady was widely expected, thus there was no shock intraday recorded for the GBPUSD, after the news release at 14:00, but rather a steady movement to the upside, as the dollar was also experiencing depreciation against major currencies.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

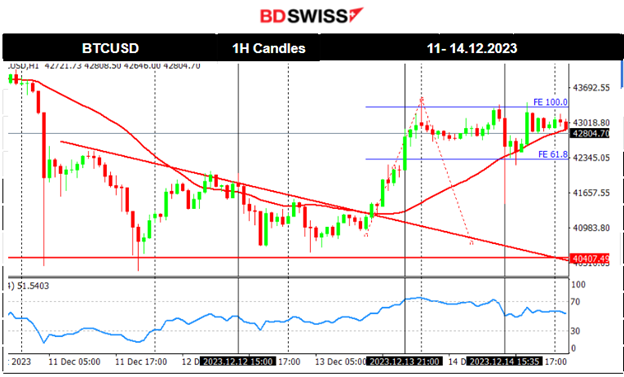

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin fell significantly during the Asian session on the 11th Dec, falling under 41K USD wiping out significant performance during the past week. This was a sudden 6.5% drawdown from 43K USD to as low as near 40K USD in a span of 20 minutes. It seems that technicals and posts from analysts caused the recent downturn. After a quick retracement, it dropped again, testing the 40300 USD level once more before finally retracing to the 30-period MA and the 61.8 Fibo level. The price path showed lower volatility levels this week forming a triangle. On the 13th Dec, the triangle broke as the price moved to the upside, reaching the resistance at near 43200 USD. Retracement was expected and finally completed yesterday, 14th Dec, when bitcoin’s price returned to the mean near 42300 USD.

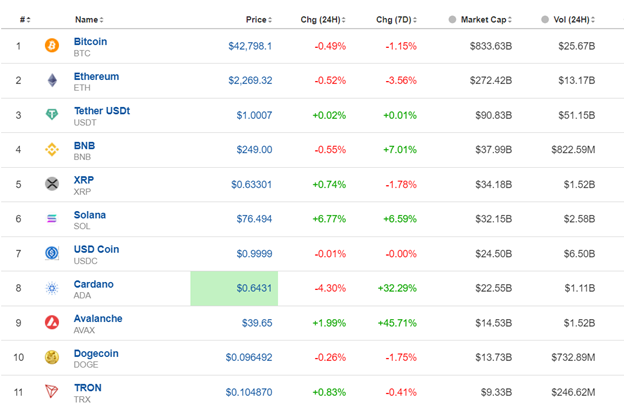

Crypto sorted by Highest Market Cap:

Mixed figures for Crypto as most saw a decrease in price following retracements. Volatility levels remain steady at moderate levels for now. Avalanche has shown a remarkable performance these last 7 days with 45.7% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

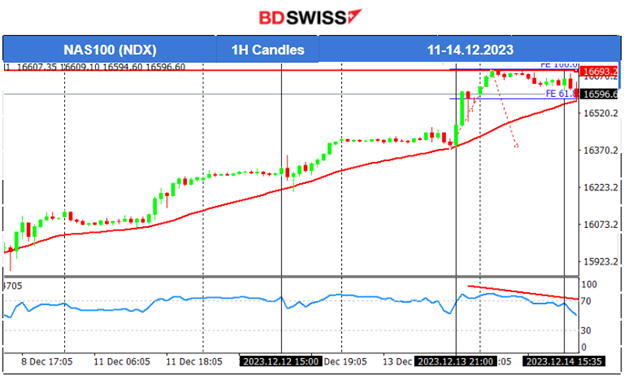

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Risk-on sentiment as market participants are pushing U.S. stocks higher and higher. NAS100 and other indices are clearly on an uptrend. This month has been good for stocks especially since the Fed is discussing rate cuts, thus future lower borrowing costs for businesses. During the FOMC news, their statements caused huge volatility in the market causing the indices to jump. Yesterday a retracement was expected and eventually took place bringing the index back to the mean before potentially continuing the upward path.

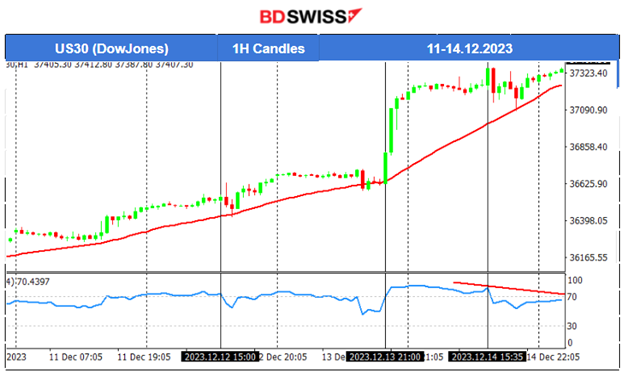

Dow Jones (US30) did not follow the same path but rather found it easier to break the resistance with little retracement to take place before that. It continues with the upward path.

In both cases the RSI shows signs of bearish divergence with lower highs, however, we need more data to suggest that there will be a turning point soon.

TradingView Analysis

https://www.tradingview.com/chart/NAS100/oQkqo1ss-NAS100-Retracement-14-12-2023/

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

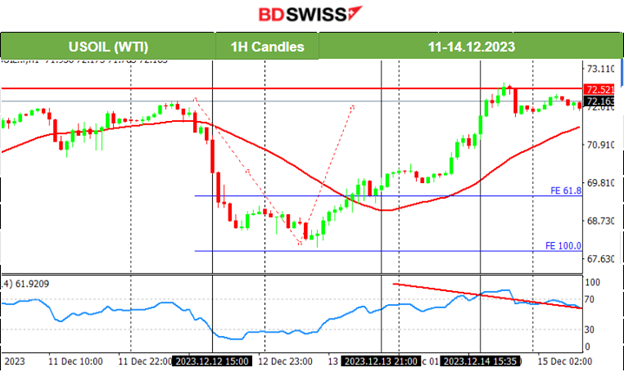

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 12th Dec Crude’s price dropped heavily during the inflation-related figure releases for the U.S. but found support near 69.5 USD/b where it eventually settled for only some time. It soon broke that support and the price reached 68.5 USD/b before retracing only a bit until the end of the trading day. Crude’s price went even lower reaching 68 USD/b on the 13th Dec showing signs of retracement. It eventually completed the retracement back to the mean, just as we predicted, and moved further upwards. Yesterday, crude moved even further upwards after central bank news and statements. The USD also experienced further weakening. Crude eventually reached even more than the significant resistance, at near 72.5 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

With the FOMC and Fed Rate release the dollar had depreciated greatly enhancing the upward path. Gold jumped until it reached the resistance at 2040 USD/oz and remained settled, around that level. The RSI however is signalling a bearish divergence. We could see Gold falling to 61.8 Fibo level soon, as depicted on the chart. This will be the case unless the resistance near the 2040-2045 level breaks eventually, showing that the shock is not over yet. This would require USD to depreciate significantly soon or a fundamental shock to take place causing demand for Gold to rise.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (15 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Industrial Production measure, a yearly change figure for China, was released at 4:00 showing an increase. Retail sales were also reported higher. The CNH and AUD were slightly appreciated at the time of the release but no major impact was recorded.

- Morning–Day Session (European and N. American Session)

PMIs today are taking place since the start of the European session currently affecting EUR and GBP negatively as the figures are grim.

The U.S. Empire State Man. The index figure is expected to be reported lower. Something expected since high interest rates are indeed having a negative impact on the sector according to recent reports. The USD might be affected at the time but not significantly.

General Verdict:

______________________________________________________________