PREVIOUS TRADING DAY EVENTS – 19 Oct 2023

The participation rate, at 66.7% in September is at its lowest level since February, suggesting fewer people are looking for work. Had that not been the case, Australia’s jobless rate would have jumped last month as per economists’ statements.

“If the participation rate had remained unchanged at 67% in September, rather than declining, then the unemployment rate would have risen to 3.9%,” said Diana Mousina, deputy chief economist at AMP Ltd.

“Companies on earnings calls may warn about the outlook and risks ahead, but they are still holding on tight to their workers as good help is increasingly hard to find,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “The economy and labour markets are simply not slowing down and time will tell if this will reignite the inflation fires that until recently were looking contained.”

The labour market is showing strength despite the U.S. central bank raising its benchmark overnight interest rate by 525 basis points to the current 5.25% to 5.50% range since March 2022. Financial markets expect the Fed will leave rates unchanged at its Oct. 31-Nov. 1 policy meeting, according to CME Group’s FedWatch Tool, given the surge in Treasury yields.

Fed Chair Jerome Powell, however, appeared to push back against expectations as rate hikes may have reached an end, telling the Economic Club of New York that the strength in the economy and labour market “could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

Source: https://www.reuters.com/markets/us/us-weekly-jobless-claims-unexpectedly-fall-2023-10-19/

______________________________________________________________________

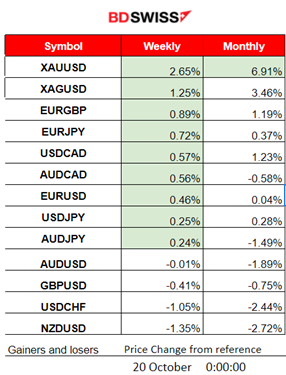

Winners and Losers

News Reports Monitor – Previous Trading Day (19 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

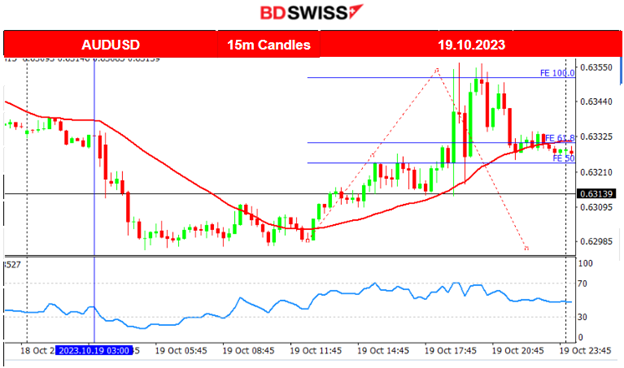

At 3:30 the labour market data for Australia came out. Just a 6.7K change in employment while the unemployment rate was reported lower than expected. Fewer Australians have been looking for work during this period. The AUD was affected by depreciation upon release but the impact was minimal. AUDUSD dropped little more than 20 pips and continued later to the downside until it found support reaching near 35 pips drop overall from the time of the news release.

- Morning–Day Session (European and N. American Session)

U.S. Unemployment claims were reported at 198K and again remain close to the 200K level. These low numbers coincide with other recent reports showing that the labour market is remarkably resilient and tight. The numbers are kind of expected to be low thus no shock was recorded at the time of the release.

The Philly Fed Man. index showed an increase of 5 points but remained negative at -9 points this month. Manufacturing activity in the region was mixed. The firms continue to expect overall growth over the next six months, but most future indicators declined. USD pairs were not affected by the release.

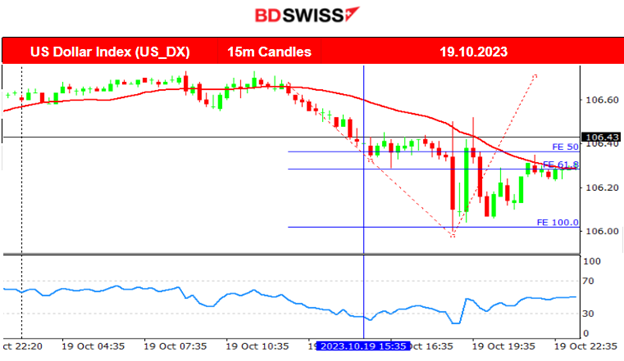

Powell: “It may be that rates haven’t been high enough long enough”. We should be seeing the effects of the monetary policy arriving” are some of the comments shared during yesterday’s speech that started around 19:00. At that time, increased volatility was observed.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

AUDUSD (19.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move to the downside early with the release of the employment data for Australia. The reported low change in employment caused the AUD to depreciate bringing the pair down close to the support 0.62950. It later reversed to the upside crossing the 30-period MA on its way up. Since the market was affected by the Federal Reserve Chair Jerome Powell’s speech at 19:00, the pair moved rapidly upwards as the USD depreciated initially, reaching the resistance at near 0.63550 with volatile moves, before finally seeing the retracement back to the mean and the 61.8 Fibo level.

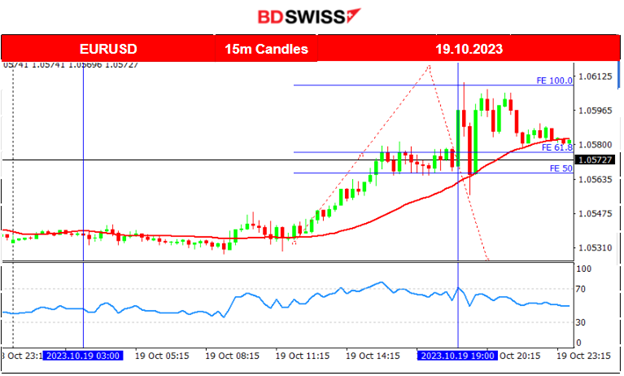

EURUSD (19.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD started to move to the upside steadily after the European Markets opened. Volatility levels were moderate for most of the trading day. However, Federal Reserve Chair Jerome Powell started his speech at the Economic Club of New York Luncheon at 19:00 and at that time volatility burst. The market and USD pairs specifically were affected by a moderate shock so the pair jumped at first at 19:00 finding resistance at near 1.06080 and soon after it reversed back to the mean before jumping again. It closed higher overall.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin continued to remain close to 28K USD. We saw that it remained in range near resistance 28900 and support 28100 after the fall from the false report. Today it actually broke the 28900 level and moved to the upside.

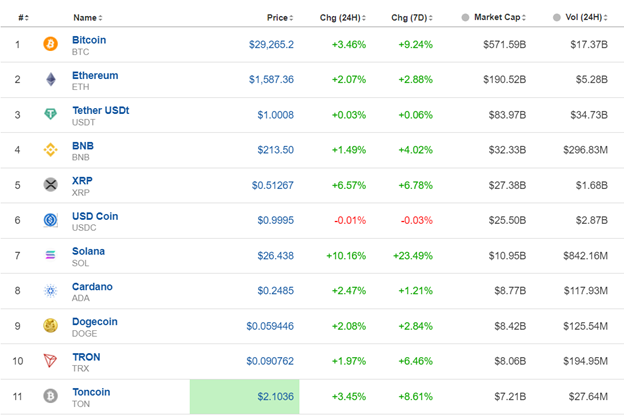

Crypto sorted by Highest Market Cap:

We saw that Bitcoin reached new higher levels yesterday. In the last 24 hours, all Cryptos have in fact been affected positively generating gains. Solana reached nearly 10% for this period while gaining 23.5% in the last 7 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 17th Oct, the index eventually dropped heavily until the support at 14940 USD before a remarkable full retracement that took place soon after. It showed amazing volatility with big deviations from the mean. Eventually, we see that the downside prevails as the stock market is currently suffering losses. All benchmark indices follow the same path to the downside. NAS100 crashed when it broke significant support levels yesterday such as the 14945 USD and moved lower even to 14825. Yesterday, after Powell’s speech, the market crashed again. It dropped near the support 14700 where currently settled.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

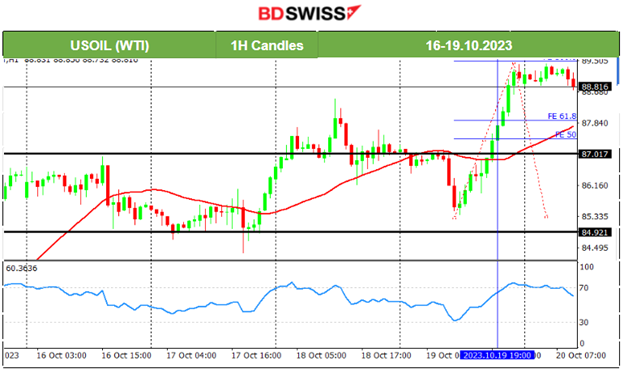

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After a period of retracement back at 84.5 USD/b Crude finally moved higher breaking the channel that was formed. On the 17th Oct, it crossed the 30-period MA on its way up and moved higher, reaching the next peak for the week at nearly 88.5 USD before retracing again to the mean. Volatility seems high. On the 19th Oct, its price moved rapidly to the upside reversing significantly and crossing the MA on its way up reaching the next resistance at 89.4 USD/b. It seems that a retracement is imminent.

Technical Analysis on TradingView:

https://www.tradingview.com/chart/USOIL/Z1M6Xu6K-USOIL-Reversal-Retrace-20-10-2023/

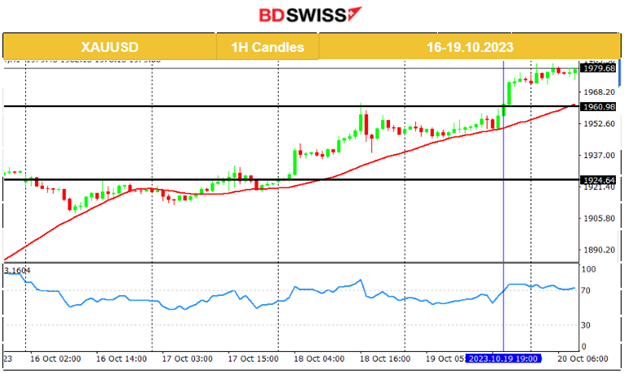

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A triangle formation was recorded this week on the 18th of Oct. The price jumped that day breaking that triangle and moving to the upside rapidly reaching the next resistance at nearly 1960 USD/oz. Yesterday, that resistance broke and Gold moved further upward reaching 1980 USD/oz. The trend is still upwards.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (20 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major announcements, no significant scheduled figure releases.

- Morning–Day Session (European and N. American Session)

At 9:00 the change in retail sales for the U.K. was released. Retail sales volumes have dropped by 0.9% in September 2023, following a rise of 0.4% in August 2023. Retailers reported that the fall over the month was because of the continuing cost of living pressures, alongside the unseasonably warm weather reducing sales of autumn-wear clothing.GBP depreciated at the time of the release.

Canada’s retail sales figures are going to be released at 15:30. The market expects that changes in volumes will be reported negative. We could see a shock intraday affecting the CAD pairs.

General Verdict:

______________________________________________________________