PREVIOUS TRADING DAY EVENTS – 26 July 2023

“The inflation picture suggests the risk remains of some further tightening in Australia in the next few months but that at the same time, we are close to the peak in interest rates,” economists at NAB said.

Goldman Sachs now expects the RBA to hike two more times. The RBA has warned that some further tightening may be required to bring inflation to heel.

Headline inflation remains far above the RBA’s target band of 2-3%, projected to return to the top of the bank’s target by mid-2025. The RBA will release its updated economic forecasts next week.

Source: https://www.reuters.com/markets/australia-inflation-slows-more-than-expected-q2-2023-07-26

The accompanying policy statement yesterday, released at 21:00, left the door open to another increase.

“The (Federal Open Market) Committee will continue to assess additional information and its implications for monetary policy,” the Fed said in a language that was a little different from its June statement and left the central bank’s policy options open as it searches for a stopping point to the current tightening cycle.

“The market’s a little bit uncertain of this because changes to the statement were fairly limited. It really is all about J Powell at his press conference coming up.”

“The only real change was the slight upgrade to economic activity from ‘modest’ to ‘moderate’ before people’s eyes glaze over at that statement. That is a bit of an upgrade in Fed parlance, so it is policymakers saying that data has been coming in stronger than expected” said Gennadiy Goldberg, Head, U.S. Rates Strategy, Td Securities, New York.

“It’s interesting to see that alongside an unchanged characterization of inflation, even though they’ve been quite optimistic that inflation will be coming down, they’ve been quite happy with the last report on CPI.”

“A rather uneventful announcement from the FOMC, with the 25 bp hike markets expected being duly delivered, and few – if any – significant changes to the policy statement. In fact, this may well be, so far at least, the most uninspiring and unexciting decision of the cycle,” said Michael Brown, market analyst at Traderx, London.

“Markets have, unsurprisingly, taken this in their stride, with attention now falling on Chair Powell’s press conference, particularly as to any guidance that may be provided in terms of whether or not the FOMC will deliver the additional 25bp hike this year called for in the June dot plot.”

“We haven’t heard Powell yet at the conference, but based on the statement, it sounds like they’re likely done for this cycle, which I think is probably one tightening too many. I think the Fed has already won the war on inflation, and perhaps they just want an extra move to make themselves comfortable,” said Jack Ablin, Chief Investment Officer, Cresset Wealth Advisors, Palm Beach, Florida.

______________________________________________________________________

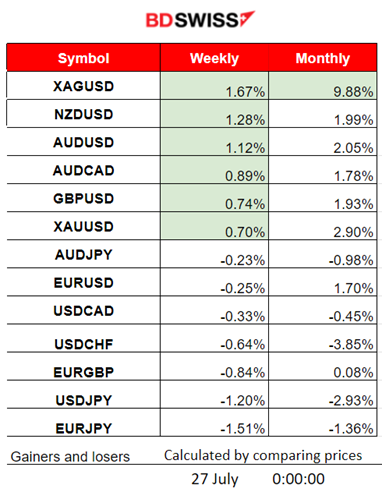

Winners vs Losers

______________________________________________________________________

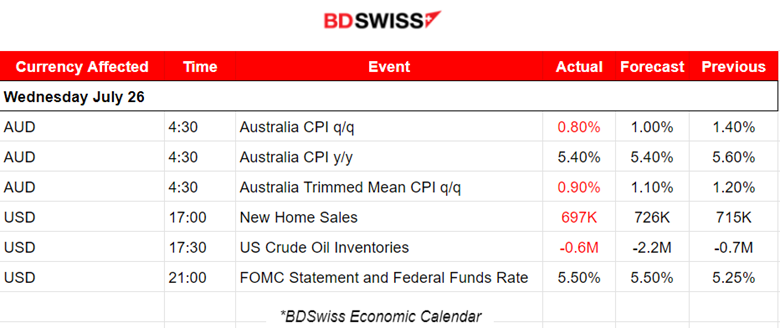

News Reports Monitor – Previous Trading Day (26 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Australia’s inflation figures were reported lower than generally expected. June monthly inflation dropped to 5.4% YoY as expected, though last month’s inflation was revised down to 5.5%. This data caused the AUD to depreciate greatly and the AUDUSD to drop close to 40 pips before retracing back to the mean shortly afterwards.

- Morning – Day Session (European)

U.S. New Home Sales figures, reported at 17:00, were recorded lower than expected, suggesting that high borrowing costs and prices are restraining momentum. No significant effect was observed on the USD pairs.

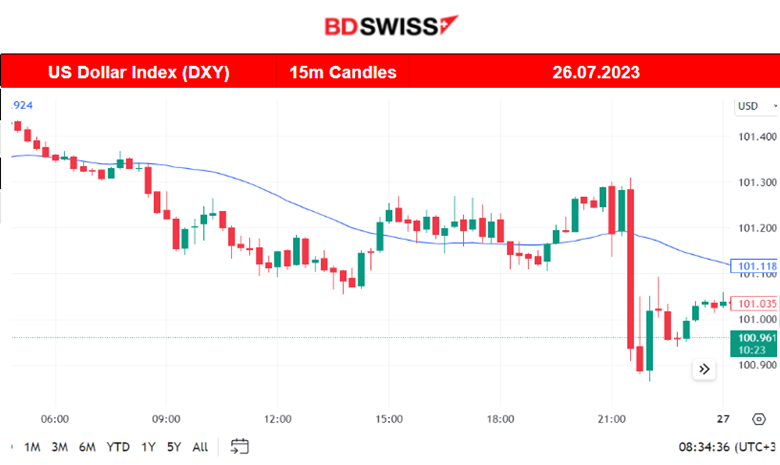

The Fed increased the Fed Funds Rate to 5.5%, 25 basis points, as expected. No intraday shock at the time of the release was observed. The market reacted with more volatility after the release when the press conference took place. Comments of Governor Powell have actually caused the USD to weaken; this is clearly visible on the DXY chart.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

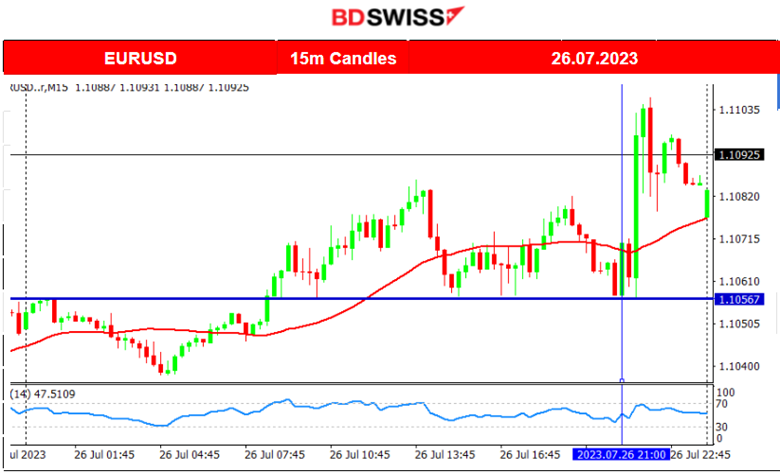

EURUSD (26.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move to the upside early during the European session. By looking at the DXY chart, we can clearly understand that the movement was USD driven as it started to weaken. During the N. American Session, the path was less volatile and sideways as the market participants were waiting for the FOMC report and Fed’s decision on rates. At the time of the rate release, at 21:00, the market had not shown significant movement. Only after 21:30, when the press conference started, was volatility higher and the pair moved in one direction, upwards, resulting from the USD depreciation that was triggered by Powell’s comments.

AUDUSD (26.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced an intraday shock early during the Asian Session when the CPI data were released at 4:30, showing an inflation slowdown. This caused AUD depreciation and an intraday shock for the AUD pairs. AUDUSD dropped more than 40 pips at that time before retracing back to the mean soon. The pair kept on testing the resistance levels near 0.67300 and somehow formed a triangle, technically suggesting that a breakout could push the pair into one direction rapidly and experience a high deviation of over 50 pips. The breakout happened during the Fed’s press conference after 21:30, when the USD showed high depreciation and caused the AUDUSD to move to the upside.

___________________________________________________________________

EQUITY MARKETS MONITOR

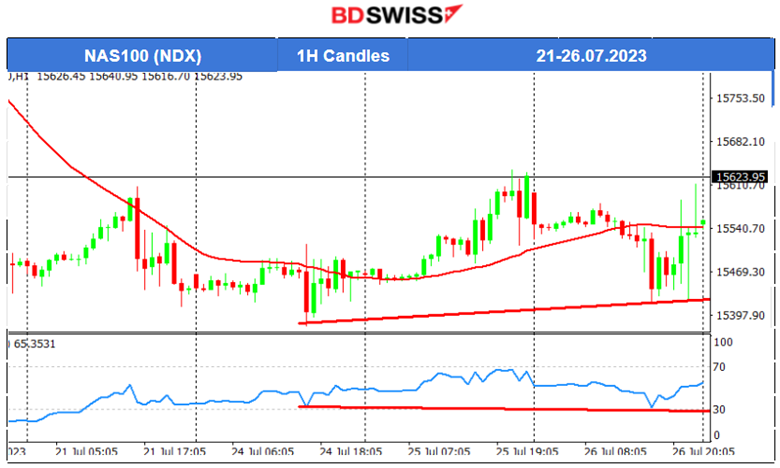

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The long and recent upward movement of the NAS100 index was interrupted. In the past week, the index moved downwards below the 30-period MA but soon found support levels to test. After failing to break them, it reversed. For the last couple of days, the index is in some kind of consolidation phase as it moves sideways with high deviations from the mean. Higher lows for the price and lower lows for the RSI do not help in suggesting a bullish divergence. However, some important resistance levels are quite visible near 15630 USD, and its breakouts could push the index more to the upside. The FOMC report and Fed rate decision, released on the 26th of July, had no significant impact on indices but caused intraday volatility, especially after the press conference started.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

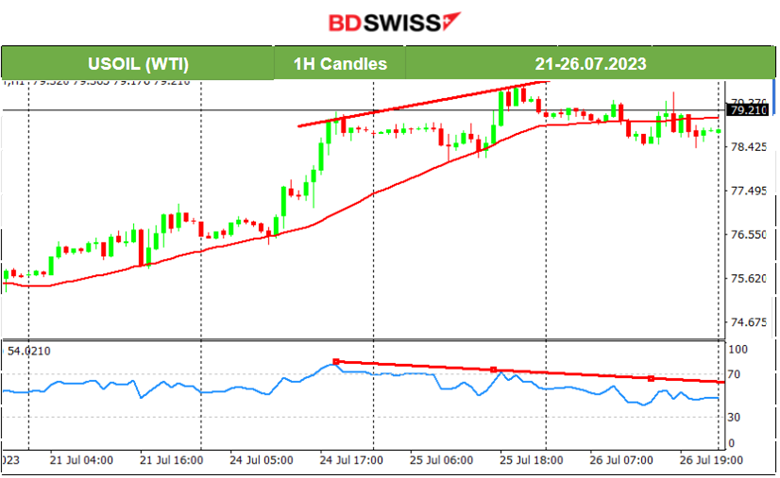

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude has been recently moving on an upward path with high volatility. The RSI was signalling a bearish divergence, with lower highs while the price was forming higher highs. The uptrend seems to be on pause for now as the RSI indicated. On the 26th, Crude moved sideways and is currently trading around the mean near 79 USD /b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold continued with the upward movement after breaking important resistance levels on the 25th of July. 1953 USD/oz was an important support that the price has not managed to break and instead, a reversal took place. Gold’s price crossed the 30-period MA on its way up and remained on the upside; the path is characterised as smooth and steady. It seems to be in an upward channel with low volatility. However, the RSI indicates that there is a bearish divergence that would cause the end of this upward path. Apparently, the price has higher highs while the RSI has lower highs.

______________________________________________________________

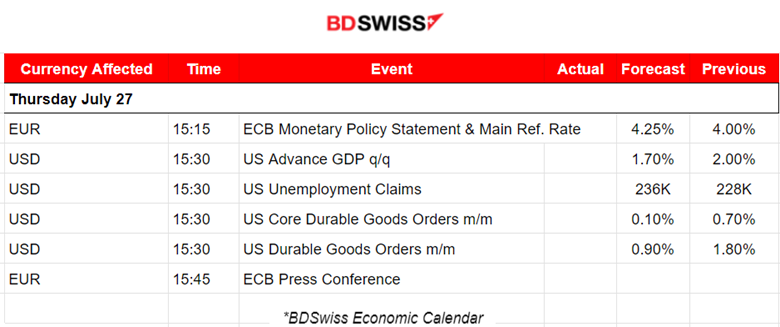

News Reports Monitor – Today Trading Day (27 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements or any special scheduled figure releases.

- Morning – Day Session (European)

The long-waited ECB rate decision is going to take place at 15:15, expecting a rate increase of 25 basis points. An intraday shock is possible even though there is less uncertainty about the outcome and it was already priced-in. However, a surprise will more likely cause a shock with high deviations of the EUR pairs from the mean.

At 15:30, there are various releases related to U.S. growth, orders and the labour market. At that time, we will probably see an intraday shock for the USD pairs. The durable goods orders are of course expected lower since consumer spending should be on lower levels and unemployment claims should be rising as a result of the rate hike impact on the labour market. Nevertheless, unemployment claims are not significantly rising; the labour market is showing remarkable resilience and if there is a surprise to the downside about that figure, it is more probable to have big moves and a moderate shock at the time of the release.

A late ECB press conference at 15:45, and during that time, more volatility is expected. I wonder if the market will react immediately at 15:15 when the MRR will be announced or wait until the press conference.

General Verdict:

______________________________________________________________