Previous Trading Day’s Events (30 Jan 2024)

Retail sales decline was reported at 2.7% on a seasonally adjusted basis, after rising 1.6% in November.

Source: https://www.reuters.com/markets/australian-retail-sales-slam-into-reverse-december-2024-01-30/

The consumer confidence index rose to 114.8 this month, the highest reading since December 2021, from a downwardly revised 108.0 in December.

“January’s increase in consumer confidence likely reflected slower inflation, the anticipation of lower interest rates ahead, and generally favourable employment conditions as companies continue to hoard labour,” said Dana Peterson, chief economist at The Conference Board in Washington. “The gain was seen across all age groups, but largest for consumers 55 and over.”

Source: https://www.reuters.com/markets/us/us-consumer-confidence-rise-two-year-high-january-2024-01-30

Recent data support however that as we enter into the new year the labour market is gradually cooling. Americans stay put at their current jobs, which could help to slow wage growth. The number of people quitting their jobs, likely in part for greener pastures, was the lowest in nearly three years.

Fed officials are expected to keep rates unchanged at the end of a two-day policy meeting today against the backdrop of a resilient economy. Financial markets have lowered the odds of a rate cut in March to well below 50%.

Source: https://www.reuters.com/markets/us/us-job-openings-unexpectedly-rise-december-2024-01-30/

______________________________________________________________________

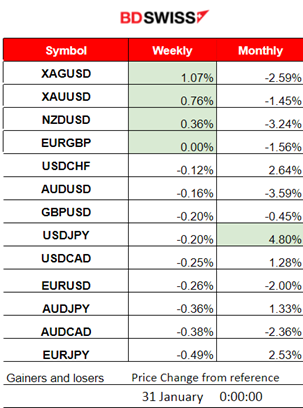

Winners vs Losers

Silver (XAGUSD) is still leading this week with 1.07% gains so far. USDJPY remains the top winner for the month with 4.80% gains.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (30 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Australia’s Retail Sales figure was reported negative for December 2023, the seasonally adjusted estimate fell 2.7% month-on-month. That was more negative than the forecast but the market was not affected greatly at the time of the release.

- Morning–Day Session (European and N. American Session)

According to the Spanish Flash annual CPI figure reported at 10:00, the estimated annual inflation in January 2024 is 3.4%, higher than the expected figure, according to the flash indicator prepared by the NSI. No major impact was recorded in the market at that time.

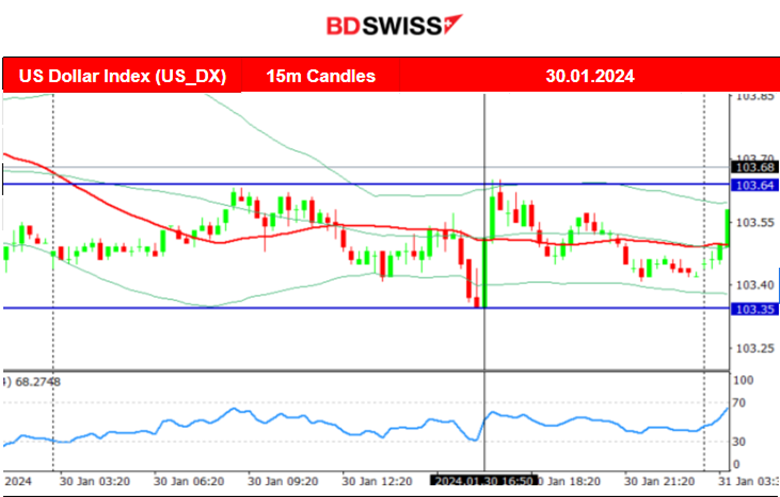

At 17:00, the CB Consumer Confidence figure was released higher, 114.8 versus 108. This shows how more optimistic are the U.S. consumers about the state of the economy than they’ve been in more than two years. Future positive expectations are reflecting slower inflation, anticipation of lower interest rates and improvement in labour market conditions. The JOLTS report, released at the same time, eventually confirmed that in December the labour market conditions indeed were hotter than anticipated. The figure shows that U.S. job openings unexpectedly rose to the highest level in three months. At the time of these report releases, the U.S. dollar appreciated moderately against other currencies. The EURUSD dropped 20 pips at that time but the effect faded soon.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (30.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

EURUSD was showing moderate volatility with an average deviation of the price from the 30-period MA to be around 15-20 pips. Near the start of the European session, it reversed to the upside rapidly finding resistance and retracing back to the MA. Before the U.S. news releases at 17:00, the dollar experienced appreciation and the EURUSD moved upwards again until finding strong resistance at near 1.08540. At 17:00 it dropped rapidly as the dollar depreciated heavily returning back to the MA. The pair continued with lower locality and sideways movement, around the mean, until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

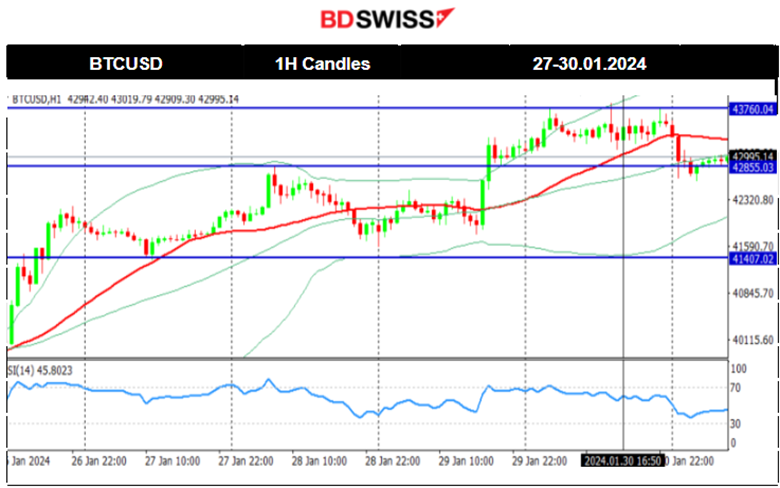

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin started to recover slowly from the recent downturn that followed after the long-awaited ETF approval from the U.S. regulator for major asset managers. On the 26th Jan, it recorded a rapid price movement to the upside, leaving from the 40,000 USD mean, and reaching the resistance 42,250 USD. Retracement followed back to the 61.8 Fibo level that coincides with the 30-period MA. The price continued upwards steadily breaking that resistance and reaching the next at 42,800 USD before it reversed back to the MA and finally settled near the 42,250 USD level. On the 29th Jan, it showed its persistence to climb further breaking the resistance at 42800 USD and reaching 43750 USD. Bitcoin did not manage to break the resistance on the 30th Jan and retraced to the MA, as predicted during our previous analysis, currently settling below 42900 USD.

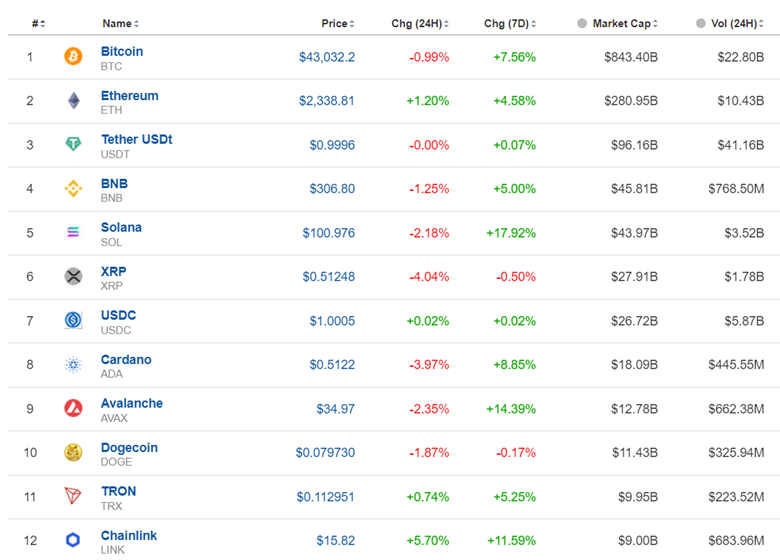

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Obviously, the market is experiencing a significant recovery. However, volatility is back and retracements are inevitable even on an upward trend. The last 24 hours retracement caused losses wiping some of the significant gains during the last 7 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The S&P 500 index broke the resistance near 4908 USD on the 29th Jan and jumped to the next resistance at 4933 USD. All benchmark indices followed the same path to the upside yesterday, an unexpected jump, late after 20:00. Retracement followed as expected, moving away from the 4933 USD resistance towards the 30-period MA and the 61.8 Fibo level. On the 30th it started to drop rapidly, reversing from the upside, crossing the MA on its way down and moving aggressively to the downside. Currently, NAS100 and S&P500 are experiencing a huge drop without retracement to take place, as expected after the reversal. FOMC tonight.

Analysis on TradingView:

https://www.tradingview.com/chart/SPX500/F5tB2Jsq-S-P500-Retracement-30-01-2024/

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil found strong support this week around 76 USD/b on the 30th Jan. It reversed upwards, crossing the 30-period MA on its way up, finding support at near 78 USD/b. Retracement followed with Crude settling near 77 USD/b. Currently, it signals a future downward movement, possibly towards the support of 76.5 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 26th, Gold tested the resistance at near 2025 USD/oz without success during the volatile moves that took place, caused by the U.S. PCE Price Index news. It reversed immediately back to the MA continuing with the path around it and settled near the range 2018-2020 USD/oz once more. A clear short-term uptrend is clear after the 25th Jan. On the 29th the price rose significantly and on the 30th Jan, it broke the 2040 USD resistance reaching 2049 USD/oz just before the U.S. news. After 17:00 gold moved lower since the news release caused dollar appreciation and the market was also putting pressure on Gold to drop, reversing back to the MA. Currently, it signals that it might test the 2040 USD and after the breakout to reach for the 2049 USD/oz again. However, FOMC today at 21:00 might create a distortion in the analysis.

______________________________________________________________

______________________________________________________________

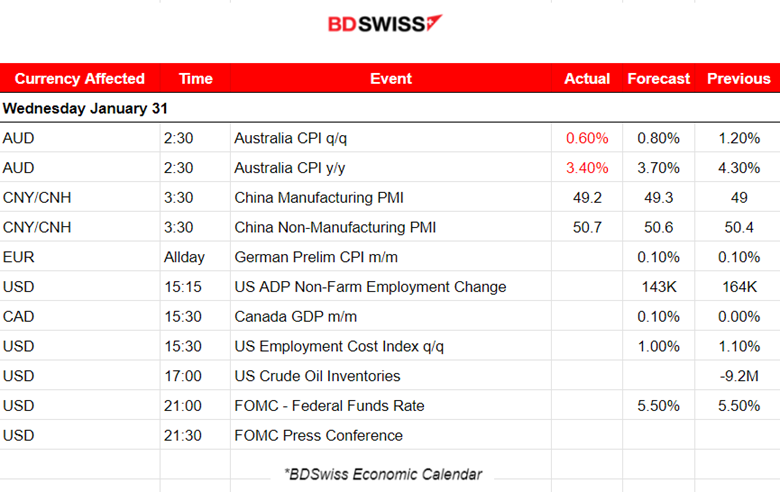

News Reports Monitor – Today Trading Day (31Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The inflation-related data for Australia were released at 2:30. The annual CPI figure was reported lower, 3.4%, surprising even the Bank of Australia’s economists on how inflation moves significantly in the desired direction. The inflation print for December is a relief to the Reserve Bank. The quarterly figure for headline inflation was also reported lower at 0.6% strengthening the case for the Reserve Bank to keep interest rates unchanged next week. The market responded with an intraday shock and AUD depreciation. AUDUSD dropped near 30 pips until finding support and significant retracement.

- Morning–Day Session (European and N. American Session)

The U.S. ADP Non-Farm Employment change figure might shake the markets at 15:15, especially the USD This is another figure this week adding to the U.S. labour data for January and is expected to be reported lower. This expectation coincides with the latest Unemployment Claims figures that showed a significant increase, indicating that the labour market might be cooling a bit as interest rate policy remains unchanged.

At 21:00, the market will be affected by the anticipated FOMC meeting and Fed Fund Rate decision. A press conference will take place 30 minutes after the release. The worldwide view is that there will be no change in interest rate policy and the shock at 21:00 will probably be moderate without surprise. However, during the press conference statements from the officials could lead to increased volatility with high deviations from the means for USD pairs and asset prices denominated in dollars. Extreme caution should take place for retracement opportunities as they tend not to be completed during that session.

General Verdict:

______________________________________________________________