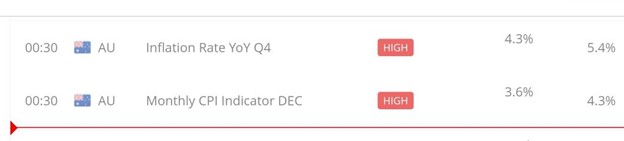

The AUDUSD is under pressure today in the Forex market, with two significant events impacting its movement. The first event is the Monthly CPI Indicator for December, which was expected to be 3.6%. However, it came in at 3.4%, causing the price to drop from 0.65943 to 0.65854. If the released CPI figure is higher than the forecast, it’s considered positive for the Australian Dollar (AUD).

Source : https://global.bdswiss.com/economic-calendar/

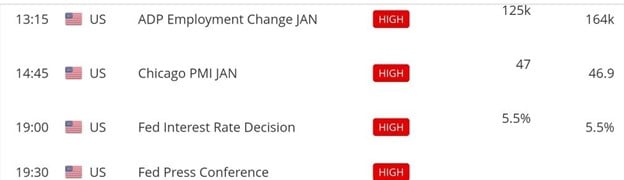

Another impactful event is the ADP Unemployment Change for January in the United States, scheduled for 13:15 GMT with a forecast of 125K. This reflects the estimated change in employed people, excluding farming and government sectors. A higher released figure is favourable for the US Dollar (USD). Later in the day, the focus will turn to the Federal Reserve’s Interest Rate Decision at 19:00 GMT. If the actual interest rate exceeds the forecast of 5.50%, it’s considered positive for the USD.

Source : https://global.bdswiss.com/economic-calendar/

From a technical analysis perspective on the 1-hour timeframe for AUDUSD, an uptrend line traced from 0.65243 was broken, indicating a reversal in the trend towards the downside. There’s a likelihood of the price dropping further to 0.65243. However, if the price reverses back into an uptrend line, it suggests a continuation of the uptrend with potential movement towards 0.66225.

Today promises to be busy for USD currency pairs, and as a trader, you may seize opportunities to gain some pips.