Rates as of 04:00 GMT

Market Recap

US stocks up nicely (3.4%) overnight and were indicated up +0.2% when I started writing this comment this morning. Most Asian markets are up too. Maybe the virus threat is over? Maybe we’re finished? HAHAHAHA! That was just a joke. Especially for us people who are still in lockdown. Moreover, the S&P 500 futures are now down 0.1%. Oops.

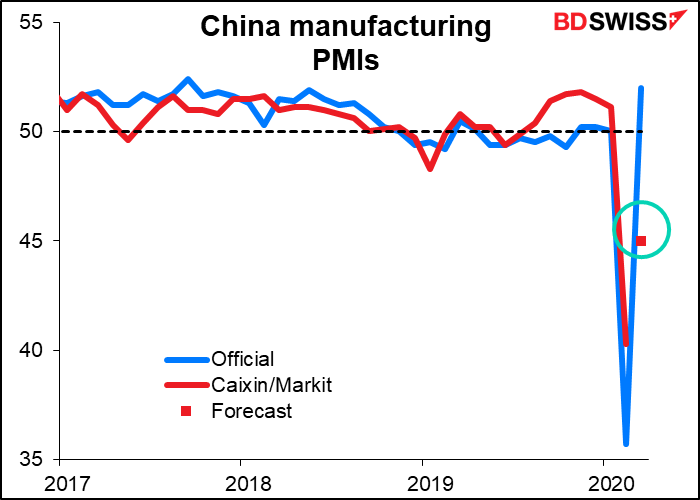

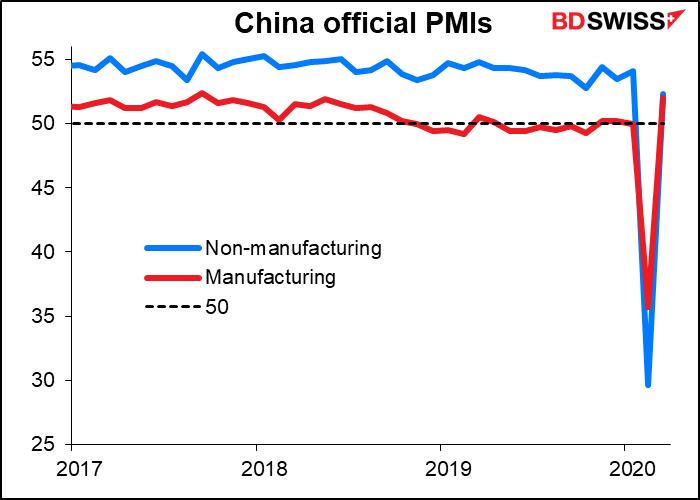

China’s official purchasing managers’ indices (PMIs) both beat expectations and managed to bound back well into expansionary territory (above the “boom-or-bust” line of 50) after hitting record lows the month before. The statement from the National Bureau of Statistics (NBS) was cautious, saying that “companies still face relatively big operational pressures” and that more firms are reporting funding shortages and falling demand than in February. Nevertheless, it does hold out hope for a relatively swift rebound in activity – a “V”-shaped recovery – once the virus is contained.

There was some very strange movement in the FX market in the ten minutes before this number came out. It apparently was related not to the number however but to the Tokyo FX fix, which is at 09:55 AM Tokyo time (00:55 GMT) every day. Today was the fiscal year-end and so a particular lot of money was riding on it.

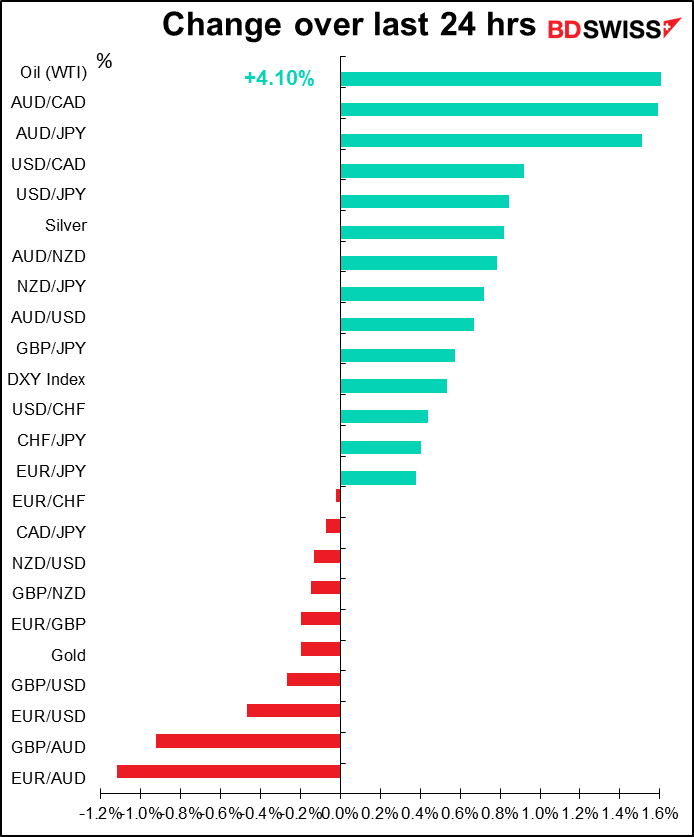

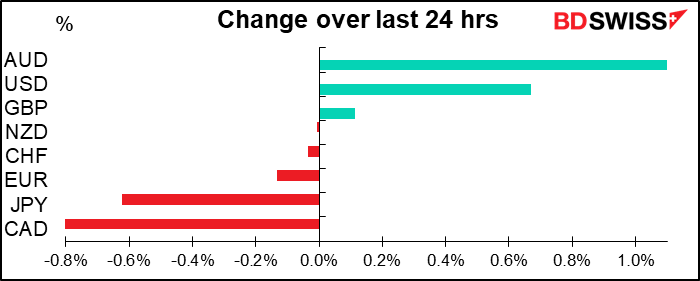

AUD/USD went shooting down, and by down I mean over an entire cent: from 0.6186 at 00:50 GMT to0.6078 at 00:54 GMT. Then it was back up to 0.6159 by 00:55 GMT. When the China PMI figure came out, it went from 0.6146 to 0.6176, and since then has spent the rest of the day in that range.

There were similar but less exaggerated moves in other currencies at the same time. USD/JPY went shooting up from 108.16 at 00:50 GMT to 108.72 at 00:54 GMT. It then fell back to 108.49 four minutes later. The release of the China PMIs didn’t have much impact on it. Similarly, EUR/USD went from 1.1032 at 00:50 GMT to 1.0984 at 00:54 GMT, then back up to 1.1019 one minute later.

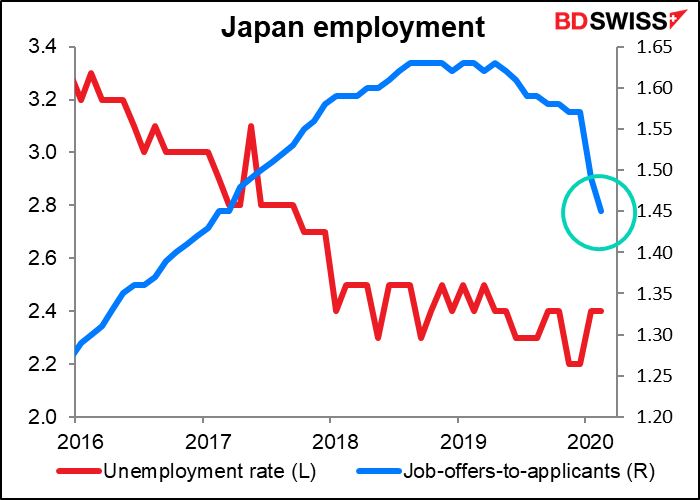

Japan’s employment data showed a worsening job market. Although the unemployment rate remained the same, the job-offers-to-applicants ratio declined more than expected. Furthermore the unchanged unemployment rate masks a shift from full-time jobs to (lower-paid) part-time jobs. I was talking with my daughter who’s at university in Japan now and she said that not only are a lot of her classmates not getting job interviews, but also some graduating seniors who had received job offers already have had them rescinded recently. The job market is clearly worsening in Japan.

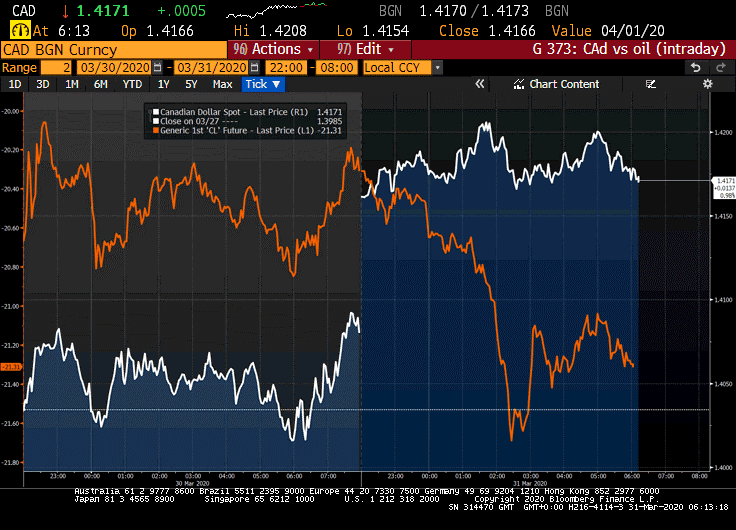

Oil briefly broke through $20/bbl yesterday as West Texas Intermediate (WTI) futures hit a low of $19.27. It managed to bounce back later in the day however and is up on the day.

The decline of oil hit CAD during the US trading day, but the recovery hasn’t fed through to the loonie yet today. We can see from the graph that USD/CAD (white line) basically followed WTI futures (orange line, inverted) during the US trading day, but today oil has recovered without much impact on CAD. Is that because of the jobless report – there was a story on Bloomberg that daily jobless claims in Canada – a series that isn’t published – rose some 56% in the last few days, according to a government official.

Nonetheless, it looks to me like the illiquid market in CAD during Asian trading has opened up a gap in the market that may be filled later by a decline in USD/CAD (i.e. a rally in CAD).

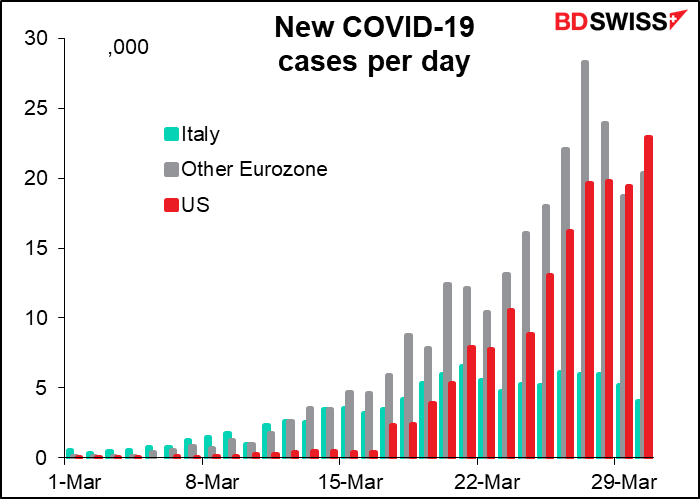

Meanwhile, back in Virusland, the rate of growth of new cases in Italy is slowing. It’s still high, but not as high as it was. Other European countries also seem to have peaked, although it’s too early to tell. Meanwhile cases in the US keep rising. This is why I think ultimately the virus will prove negative for USD – because the US government is incapable of mustering a convincing response to it and so the US situation will probably be worsening long after other countries are starting to emerge from it.

I read an interesting article that pointed out both the US and South Korea learned about the virus on the same day. Currently, South Korea has 9,786 cases and the US has 163,807. Just saying.

Meanwhile it hasn’t escaped notice that the EU as a supranational body has not mustered such a cohesive response to the crisis either. On the contrary, one of the first responses of the EU’s members has been to shut their borders and effectively disaggreage the EU. Nevertheless, the European national governments seem better able to deal with their local problems than the equivalent in the US, the state governments, because the US state governments are more reliant on the (incompetent) US Federal government than the European national governments are on the EU.

Today’s market

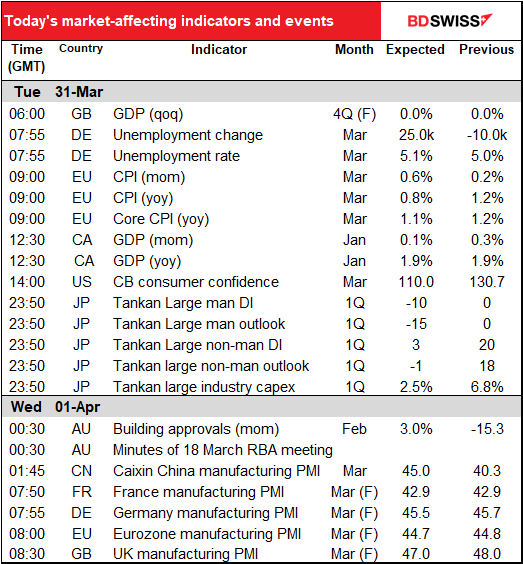

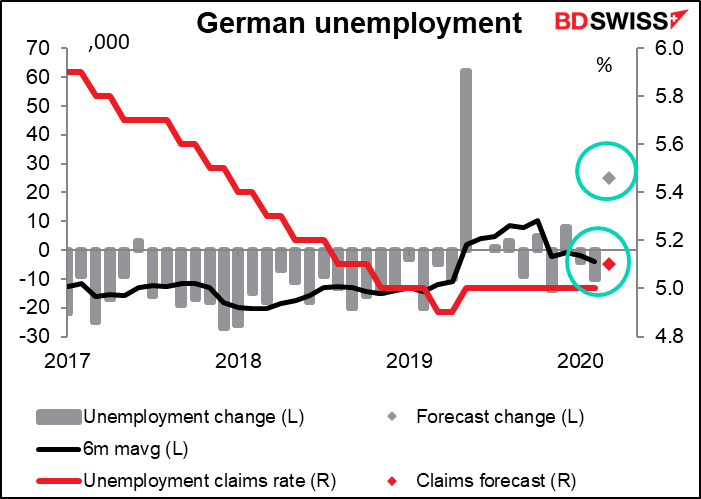

Germany releases its employment data. The number of unemployed is expected to rise more than it usually does (in fact, it usually falls), but nothing spectacular. Similarly, the unemployment rate is forecast to rise a bit but just back to where it was towards the end of 2018, which was no big deal.

We’ll have to see how long Germany (and Japan) can maintain employment. I suspect that they’ll do a better job in this respect than the Anglo countries, which is likely to mean a faster recovery as well. That’s going to be an interesting comparison of the different employment systems. Even after the Hartz reforms in the early 2000s, the German labor market is much more protected than the US market, where “at will” contracts remain the norm.

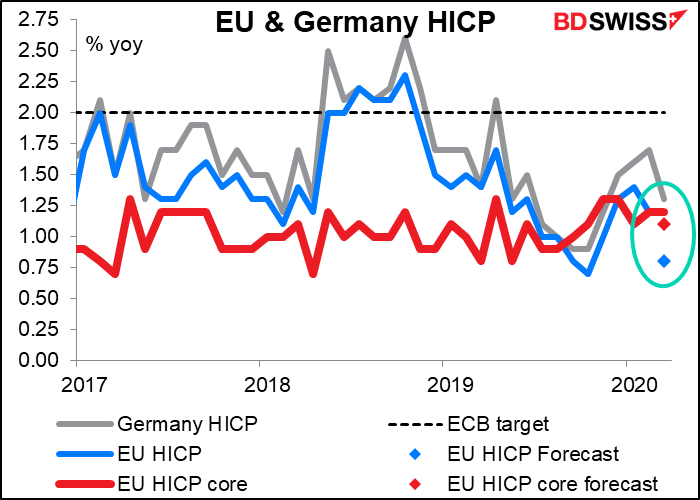

The EU-wide consumer price index (CPI) is expected to slow (or, more accurately, growth in the CPI is expected…But you know what I mean.) This isn’t just because of oil, as the core CPI is also forecast to slow too. Yesterday’s German CPI slowed in line with expectations.

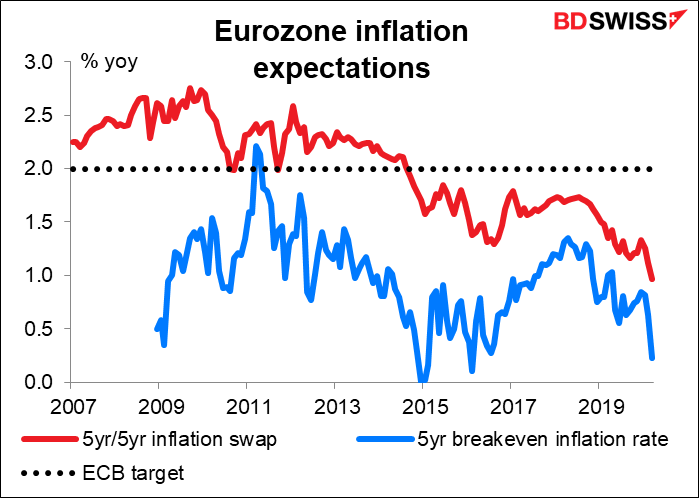

At this point, inflation isn’t the biggest worry facing the European Central Bank. But somewhere in the back of their minds it must worry them that EU inflation expectations, as measured by their favorite gauge – the 5yr/5yr inflation swap – are at a record low, even lower than during the 2008/09 Global Financial Crisis.

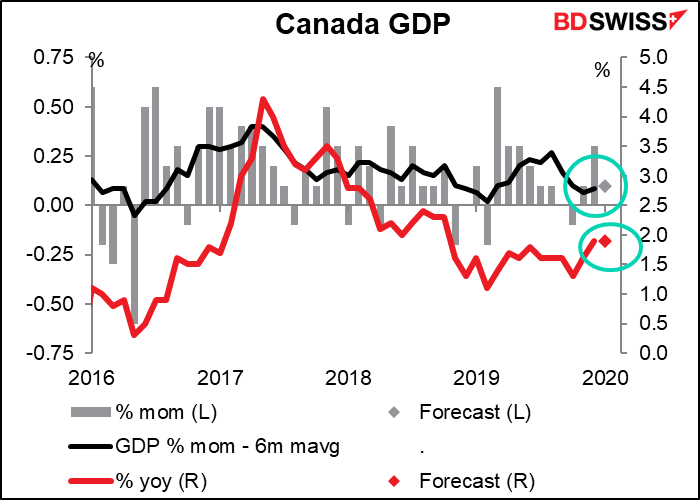

Canada’s January GDP is forecast to have grown by +0.1% mom or 1.9% yoy, the same yoy rate of growth as in December. This would show that the acceleration in growth we saw at the end of 2019 continued into 2020. Why do I get a feeling then like watching a horror movie as the heroine, smiling and talking on her phone, goes into a house where we know the killer is waiting for her…?

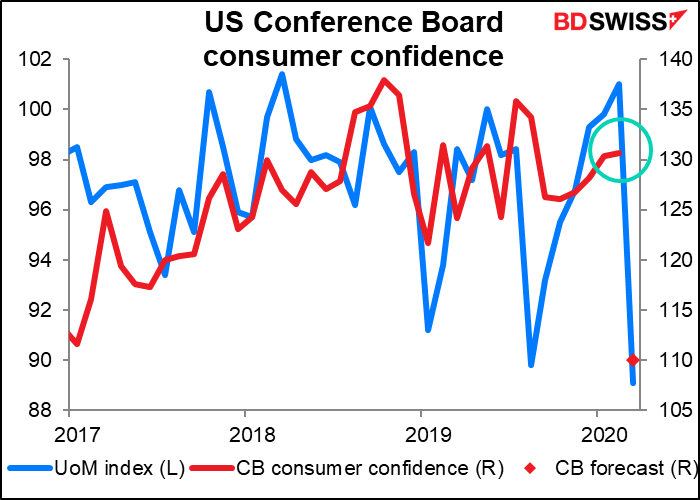

The US Conference Board’s consumer confidence index is expected to plunge. No big surprise here! The U of Michigan’s consumer sentiment index fell 11.8%, this one is forecast to be down 15.8%. I’m surprised it’s only down that much. 3.3mn suddenly unemployed people are probably pretty low on confidence about consuming right now.

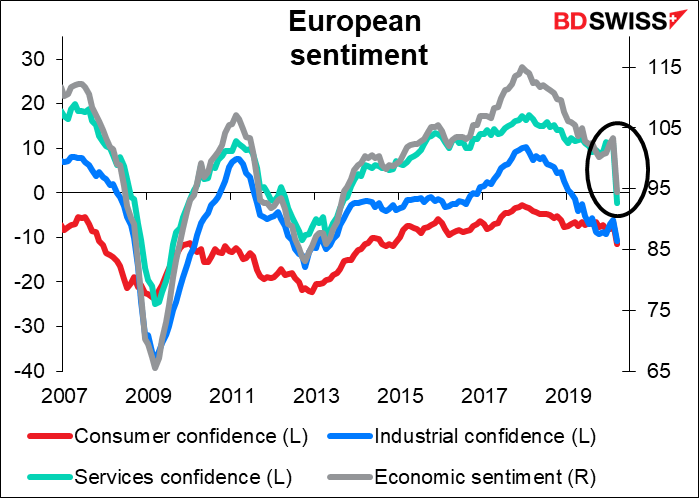

This comes a day after economic sentiment in the Eurozone – consumer, services, and overall economic sentiment — suffered a record fall. (Industrial sentiment didn’t, consistent with what the purchasing managers’ indices showed). Am I surprised? Are you surprised? How’s your economic sentiment?

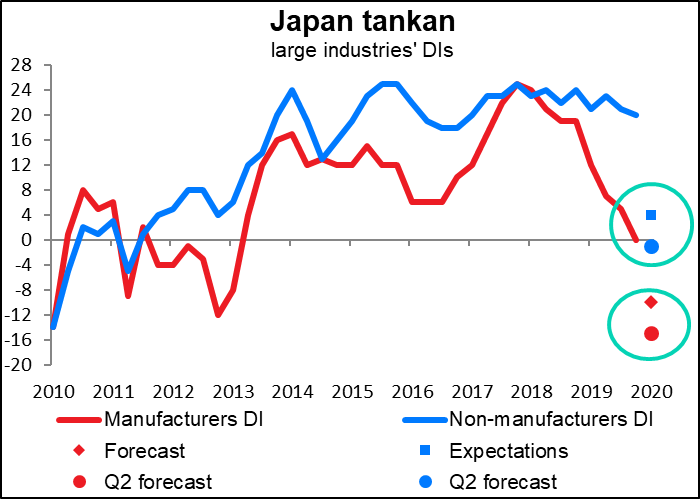

Overnight, the Bank of Japan releases its short-term survey of economic conditions, universally known by its Japanese acronym the Tankan report. It’s expected to be pretty bad. The forecast 10-point drop in the large manufacturers’ diffusion index (DI) would be the largest fall since the March 2011 Tohoku earthquake, while the forecast 16-point decline in the large non-manufacturers would be the biggest drop since Q1 2009, the depths of the Global Financial Crisis. And the indices are expected to keep falling the next quarter, too.

Oddly enough, the non-manufacturers’ DI is expected to remain positive and even in Q2 is expected to go only to -1, whereas the manufacturers’ DI is expected to go deeply into negative territory this quarter. This contrasts with the experience of other countries (and also the Japanese PMIs), where the service sector has borne the brunt of the downturn. Apparently, information services and communication are booming in Japan, plus real estate and construction were helped by the mild winter.

I imagine however that sentiment may have been artificially boosted by the Japanese government’s sanguine attitude towards COVID-19 and the relatively low number of cases that were officially declared. Interesting isn’t it how shortly after the Olympic Committee delayed the Tokyo Olympics, the Japanese government starts implementing measures to slow the progress of the virus.

Somehow I think the forecasts for Q2 are on the optimistic side.

The Caixin China manufacturing purchasing managers’ index (PMI) is forecast to recover somewhat, but not back into expansionary territory, for March. That would be a worse performance than the official manufacturing PMI, released Tuesday morning, which bounced back to 52.0 from a record-low 35.7 in February. The February number was even below the Global Financial Crisis low of 38.8 set in November 2008.