Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

I’m convinced that when I finally retire, many years from now, the last comment I ever write will include the sentence “Brexit talks are to continue as the two sides once again failed to meet the deadline and agreed to extend their discussions.” How many deadlines have come and gone and yet the talks are still alive? Supposedly the dinner discussion last night between UK PM Boorish Johnson and European Commission President Ursula von der Leyen was the last chance for an agreement so that EU Chief Negotiator Barnier could put the conclusion to EU leaders at the summit today and tomorrow. Instead, the UK side said “very large gaps remain” while Ms. vdL said the two sides “remain far apart.” That sounds familiar.

Ms. vdL said, “We agreed that the teams should immediately reconvene to try to resolve these essential issues. We will come to a decision by the end of the weekend.” Hah! How do you say “fat chance” in French? (“Grosse chance” apparently, but I’m not sure it has the same meaning.) An EU diplomat told the FT, “It’s hard to see what could happen between now and Sunday to alter the equation. It looks like we’ve now hit the home stretch with brakes and steering wheel locked.”

Perhaps we shouldn’t be so cynical, however. Deciding on Sunday night is SOP for the EU, which in my recollection makes most of its important decisions at 11:55 PM Sunday.

So who knows? We may get a decision one way or another on Sunday. Then again, they could just delay until 27 December. Or even let it go until after the UK had crashed out of the EU without any agreement and is learning what a “no-deal” Brexit entails in fact, not just in theory. It seems from some of the horror stories in the Brexit-favoring UK press that they hadn’t understood what Brexit was all about. They were astonished to find out that Britons would need an international driving license to drive on the Continent or that people with a summer home in Spain would only be allowed to spend three months out of every six months there, things that anyone from outside the EU who travels there frequently knows are common sense.

What’s most interesting though is that the failure of this supposedly last-ditch effort didn’t have that much impact on GBP. This morning when I ran my spreadsheet GBP/USD was quoted at 1.3368 vs 1.3377 at the same time yesterday morning – 9 pips change — and EUR/GBP at 0.9051 vs 0.9065 – 14 pips. GBP/USD had climbed to1.3478 at around the US open yesterday on hopes that the dinner would result in more than just a good meal but then retraced its path after the disappointing result became known. It does look as if failure is pretty well discounted in the market, although you never know till you see its ugly face staring at you. Perhaps everyone has the same idea: that as always with the EU, agreement will come in the last possible five minutes.

Meanwhile, speaking of “kicking the can down the road because you’re unable to reach an agreement,” the US House of Representatives overwhelmingly approved a one-week stopgap spending bill that would push tomorrow’s deadline for funding the US government to Dec. 18. The move averts the immediate threat of a shutdown as negotiators continued to haggle over both a broader spending package and the pandemic aid bill. The Senate is expected to approve the extension. However, the two sides remain far apart on the pandemic aid bill. The ebb and flow of information about that bill’s progress will no doubt affect the “risk-on” or “risk-off” mood of the market.

The lack of any progress on these two crucial issues led to a weak stock market. The S&P 500 hit an intraday record high but ended down 0.8%. NASDAQ was down 1.9% after an analyst at JP Morgan said Tesla (-7.0%) was “not only overvalued, but dramatically so” and the US Federal Trade Commission and other US authorities sued Facebook (-1.9%) for anti-competitive behavior. The Facebook suit seeks to get the company to divest Instagram and WhatsApp. It’s astonishing that this long-delayed antitrust legislation is coming from the Trump administration, but wonders never cease.

The selling seems to be slowing however as Asian markets were mixed this morning, while S&P 500 futures were down only slightly (-0.1%).

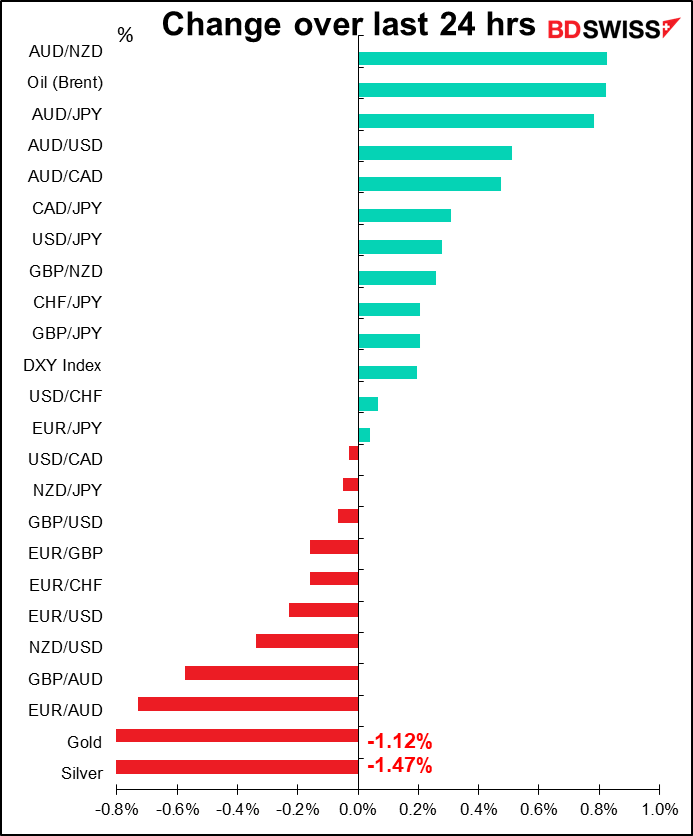

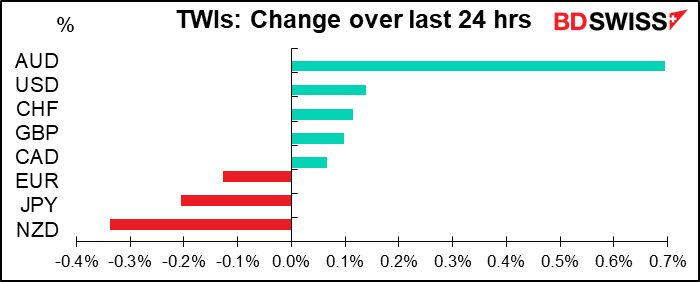

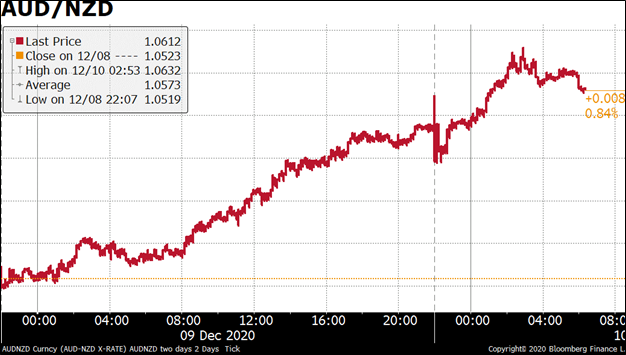

Meanwhile, getting back to the FX market, it’s rare to see AUD/NZD at either of the extremes in my table of market movements, as it is today. There doesn’t seem to have been any specific trigger to push AUD up vis-à-vis NZD as the pair climbed steadily throughout the day yesterday, although it has started to turn down in Asian trading today (see graph). I would expect further retracement in the pair today as I don’t think there’s anything to warrant such a suddenly negative view on NZD.

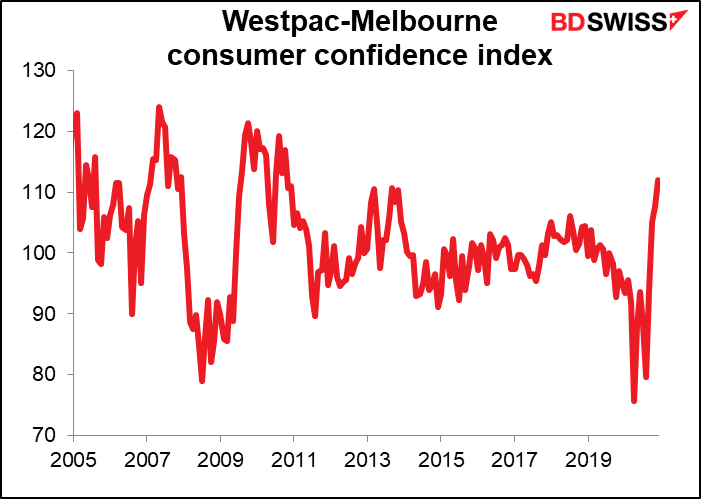

AUD was boosted by the highest consumer confidence reading since October 2010 as the lifting of various lockdown restrictions and a massive fiscal/monetary stimulus helped to reboot the economy.

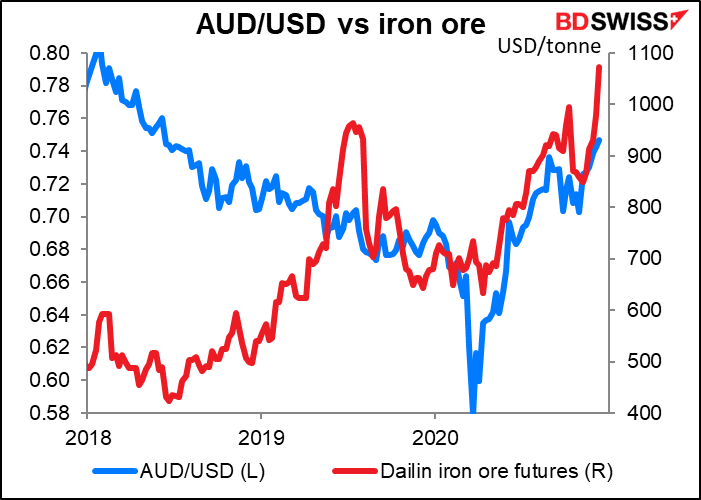

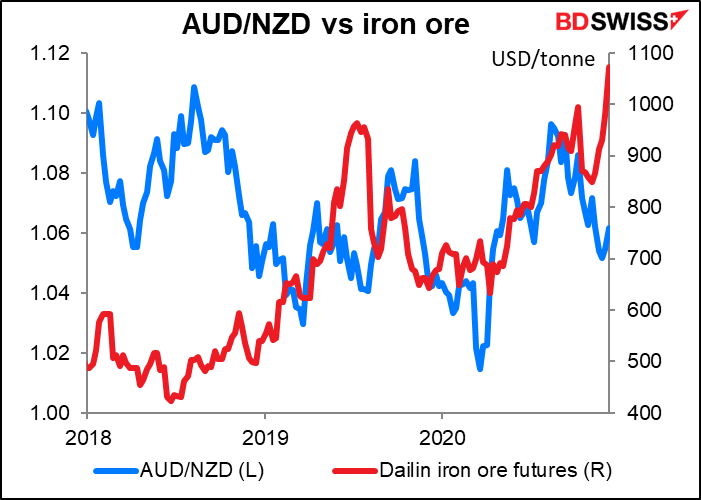

Plus surging iron ore prices. The correlation between AUD/USD and iron ore broke down during 2018, although it may be coming back, while the correlation between iron ore and AUD/NZD has never been that great.

The question then is, why vs NZD? NZD/USD was down slightly, with no apparent drivers. My guess is that people who wanted to buy AUD simply did it vs NZD, not that they were taking a particularly NZD-negative stance.

Other currencies, astonishingly enough, were barely changed, including GBP.

According to CLS, an FX settlement company, there has been an unusual amount of activity in AUD/JPY this morning.

Today’s market

Big day today!

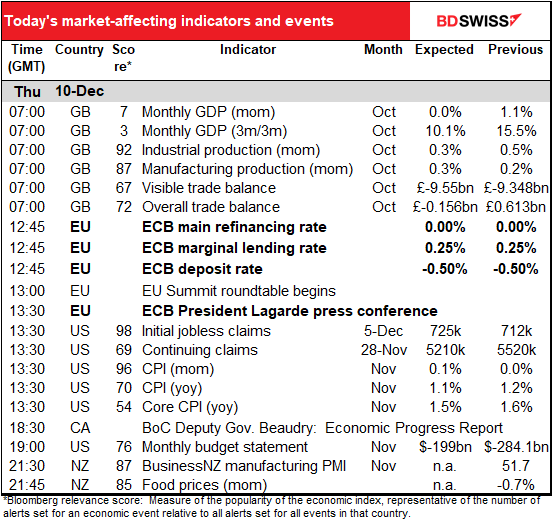

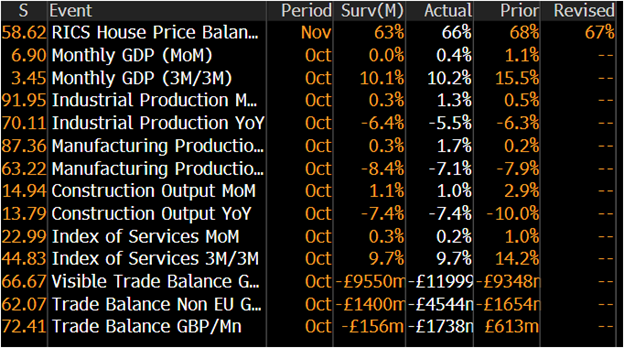

We already discussed the UK short-term indicators, which anyway are already out. They were much stronger than expected, with both GDP and industrial & manufacturing production exceeding their forecasts substantially. Unfortunately the trade deficit also exceeded its forecasts, too. All told though the indicators were good news for the UK, as they suggest the UK economy is in better shape than people had thought. However that doesn’t seem to be having any impact on GBP, which continues to fall on the Brexit impasse.

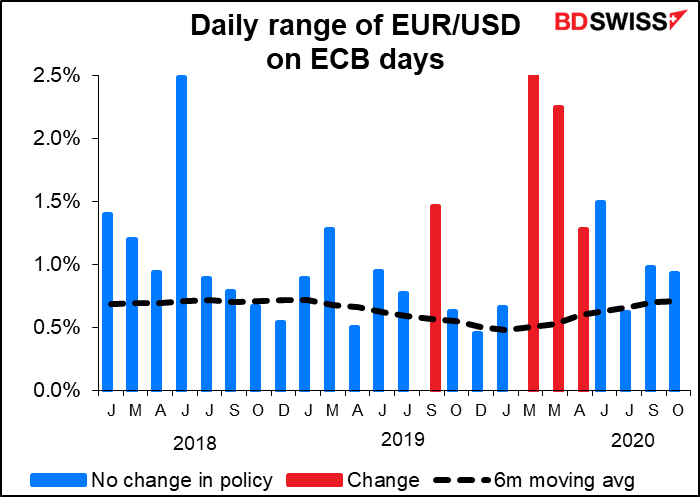

So now we’re on pins and needles waiting for the European Central Bank (ECB) meeting. I sent out a separate item about this yesterday discussing it in excruciating depth and detail (see “ECB: Readying a Bazooka”). For those who missed that and just want the bottom line, here it is:

What they’re likely to do: The market is looking for the Bank to “recalibrate” their two key pandemic tools of the Pandemic Emergency Purchase Program (PEPP), which allows for flexible asset purchases, and the Targeted Long-Term Repurchase Operations (TLTROs), i.e. cheap bank funding to maintain easy financing for companies while the economic impact of the crisis continues. PEPP is likely to be extended by at least six months until end-2021 and increased by some EUR 500bn to EUR 1.85tn so that aid can continue at the current pace until activity returns to pre-pandemic levels.

Impact on the currency: In general, quantitative easing measures such as these have more of an impact on the exchange rate than cutting interest rates by a small amount does. Cutting rates by 10 bps, which is all the ECB could do at this point, would have little impact even if it were deeper into negative territory. Further quantitative easing on the other hand could make foreign bonds even more attractive vis-à-vis EUR-denominated bonds and induce further portfolio flows out of euros, which might weaken the currency. However, in this case the moves are fairly well anticipated and so unless there’s a major surprise in the package, I don’t expect the euro to weaken significantly. We could even see some “sell the rumor, buy the fact” appreciation in the currency.

At about the same time the ECB meeting ends, the European Council summit begins. According to the official agenda, “EU leaders will meet in Brussels to discuss further coordination on COVID-19, climate change, security and external relations.” Ms. vd Leyen will also brief them on the Brexit negotiations.

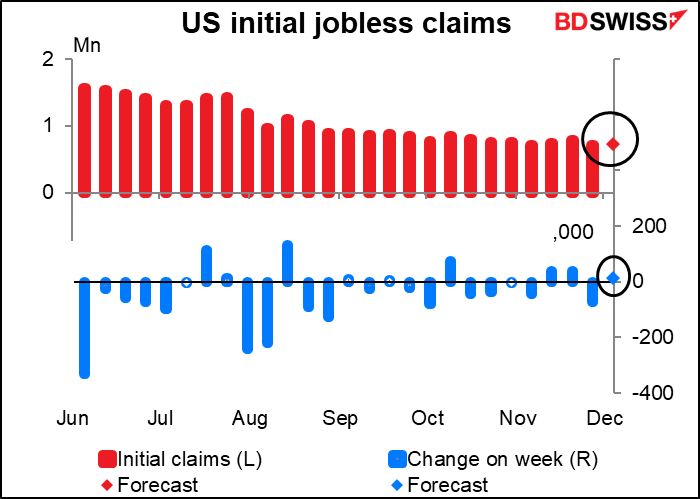

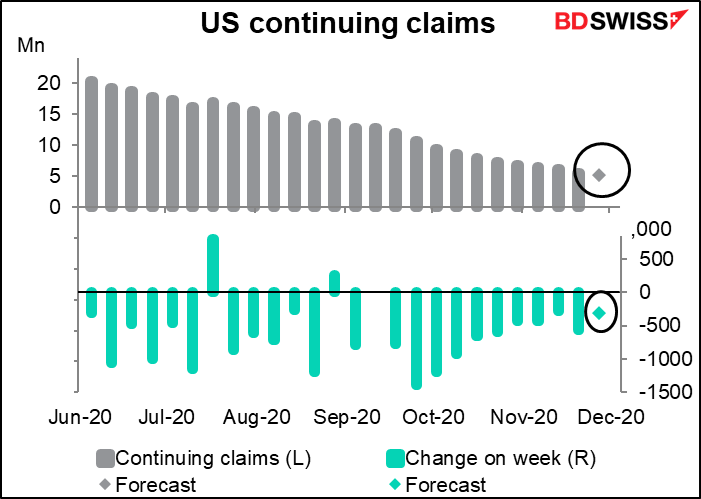

The US jobless claims are expected to show that even the pathetically slow improvement in the job market has ground to a half. Initial claims are expected to rise by 13k. Continuing claims are expected to keep falling, but no one pays much attention to that series anymore because it’s distorted from so many people running out of unemployment benefits.

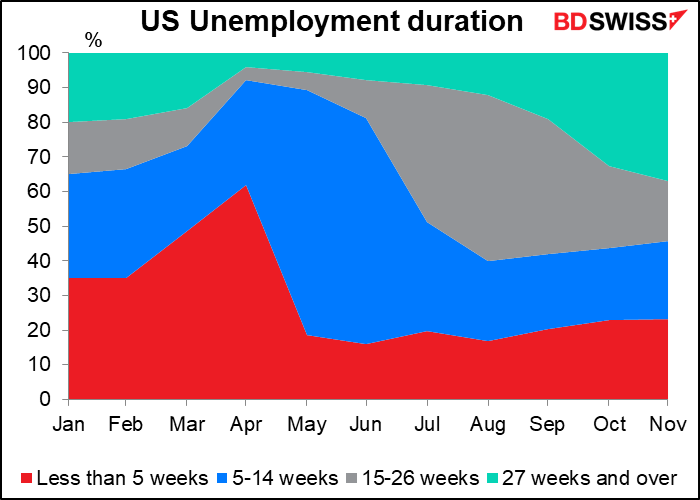

As you can see, the percentage of unemployed who’ve been unemployed for 15-26 weeks is falling and the percent who’ve been unemployed for 27 weeks and over is rising. It looks like people are moving out of the former category and into the latter, which means they’re also falling off the state uninsurance rolls.

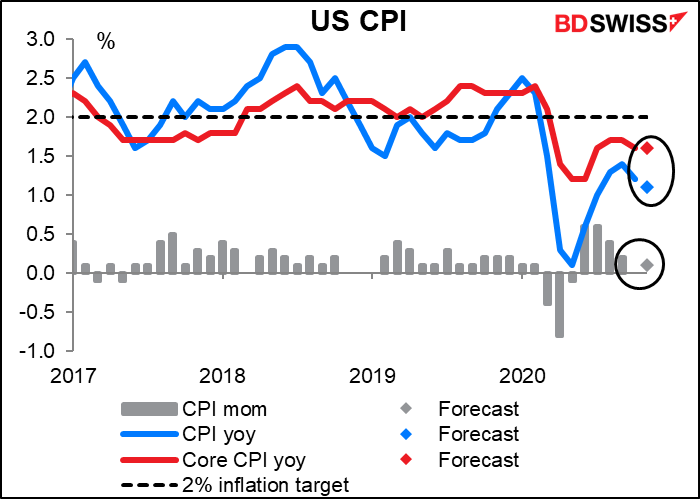

The US consumer price index (CPI) used to be one of the biggest indicators of the month, but nowadays central banks are responding to the overall economy, not necessarily inflation. So it might affect the bond market and through that it might affect the FX market, but the usual chain of transmission, in which lower inflation is expected to trigger Fed loosening and is therefore negative for the currency, is now broken. If anything, lower inflation means higher real interest rates and therefore might be good for the currency.

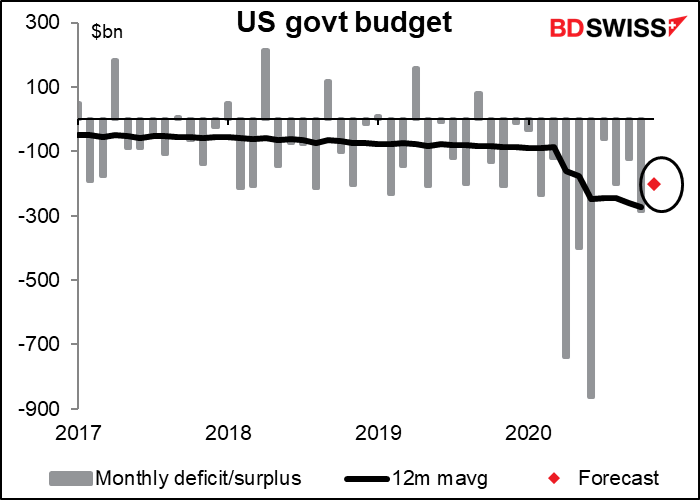

The US government budget deficit is expected to narrow slightly to $200bn. Don’t get too excited though, because if they do pass that $980bn fiscal rescue package, the deficit will explode again. I include this just for fun because nowadays no one cares about budget deficits at all.