Previous Trading Day’s Events (08.08.2024)

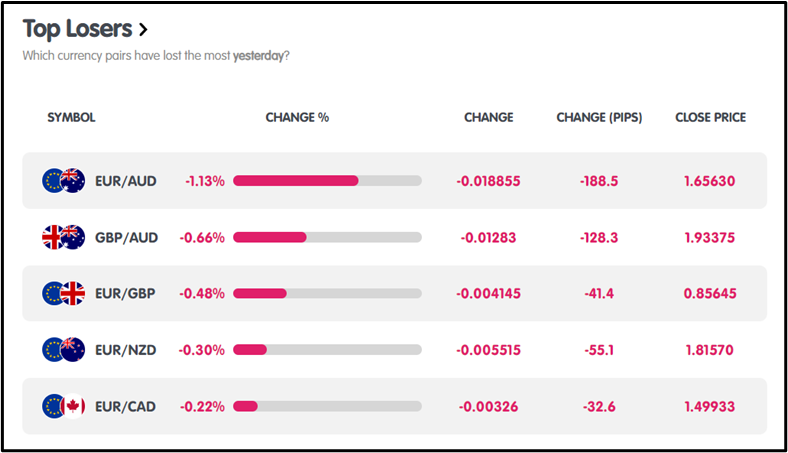

New Zealand Business 2-Year Inflation Expectations: Reduced to 2.03% from 2.33%.

United States Initial Jobless Claims: Decreased by 17K to 230K, under the 240K forecast.

______________________________________________________________

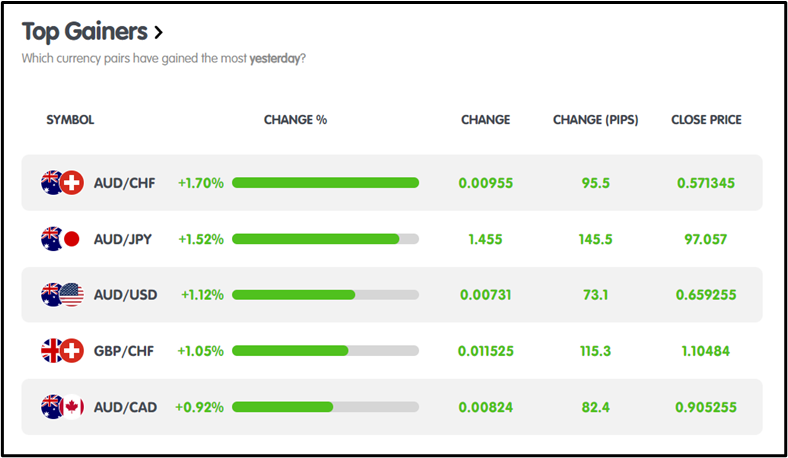

Winners Vs. Losers

On August 8, 2024, AUD/CHF led gains with a +1.70% move and +95.5 pips, while EUR/AUD lagged, losing -1.13% and -118.5 pips.

On August 8, 2024, AUD/CHF led gains with a +1.70% move and +95.5 pips, while EUR/AUD lagged, losing -1.13% and -118.5 pips.

News Reports Monitor – Previous Trading Day (08.08.2024)

Server Time / Timezone EEST (UTC+03:00)

General Verdict

______________________________________________________________

FOREX MARKETS MONITOR

EURUSD (08.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EUR/USD showed a bearish trend, opening at 1.09210, closing at 1.09167, with a high of 1.09458 and a low of 1.08800.

CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

BTCUSD (08.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

BTC/USD showed a bullish trend, opening at $55,124.27, and closing at $59,508.70, with highs of $59,968.69 and lows of $54,555.92.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

NVIDIA (08.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NVDA showed a bullish trend, opening at $100.95, and closing at $104.99, with a high of $105.60 and a low of $97.34.

EQUITY MARKETS MONITOR

EQUITY MARKETS MONITOR

S&P500 (08.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The S&P 500 displayed a bullish trend, opening at $5,180.75 and reaching a high of $5,332.19, with a low of $5,157.58.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

USOIL (08.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

USOIL showed a bullish trend, opening at $74.578, and closing at $75.207, with a high of $75.598 and a low of $73.779.

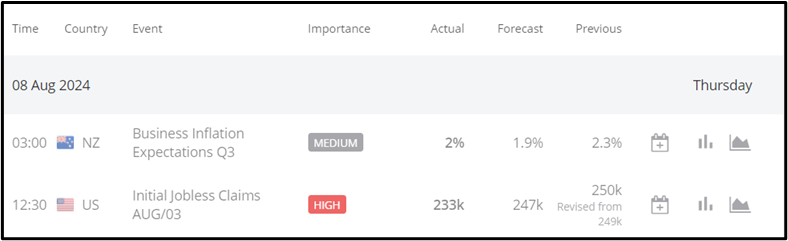

News Reports Monitor – Today Trading Day (09.08.2024)

News Reports Monitor – Today Trading Day (09.08.2024)

- Tokyo Session: No significant data.

- London Session: No significant data.

- New York Session:

Full-time employment change in July: Forecast 10K, previous -3.4K.

Employment change in July: Forecast -5K, previous -1.4K.

The unemployment rate in July was forecasted to be 6.4%, and the previous was 6.4%.

General Verdict

Source

https://km.bdswiss.com/economic-calendar/

Metatrader 4 (MT4)