PREVIOUS TRADING DAY EVENTS – 22 June 2023

The decision was taken amid fears of rising inflationary pressures.

“The marked decline in recent months is very welcome,” Chairman Thomas Jordan of the Swiss National Bank (SNB) said. “Nevertheless the underlying inflationary pressure has risen further.

“That means most likely that tighter monetary policy is necessary to bring inflation sustainably below 2%,” he said, “But we can also afford the more gradual approach.”

Inflation projections remained high.

“Inflation would most likely not stabilise but would rather go up again and we would have to fight inflation further down the road with more rate increases,” he said.

“The economy is doing better than expected but inflation is still too high and we’ve got to deal with it,” said Governor Andrew Bailey, who has been criticised for not acting decisively enough. “If we don’t raise rates now, it could be worse later.”

“Inflation pressures show more persistency and more momentum than other western economies, and that forces the Bank into a hawkish corner,” Joseph Little, global chief strategist at HSBC Asset Management said, adding there were concerns that the BoE might have to raise rates as high as 6%.

Inflation is stubborn and refuses to lower.

The numbers are still high and trouble the Fed who decided to pause.

Source:

______________________________________________________________________

Summary Daily Moves – Winners vs Losers (22 June 2023)

- The JPY pairs are still on top. This week EURJPY and USDJPY are having the most gains with 1.22% and 1.09% respectively.

- The month still finds AUDJPY on the top with 6.09% gains.

______________________________________________________________________

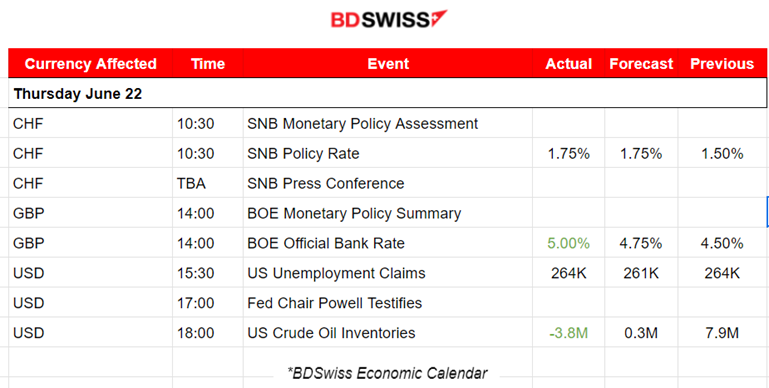

News Reports Monitor – Previous Trading Day (22 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

The Swiss National Bank (SNB) decided to increase the SNB policy rate to 1.75% matching expectations and tightening monetary policy further. At the time of the release at 10:30, the market experienced a shock, affecting CHF pairs. No clear direction yet.

The Bank of England (BEO), at 14:00, surprised the markets with a 50 basis points rate increase, bringing the OBR to 5%. It was expected that rates will increase by the standard 25 basis points. The market reacted with a shock but did not experience a movement in one direction.

The U.S. Unemployment claims figure was released at 15:30 and was reported to be 264K, the same as the previous figure. Policymakers are waiting for a reduction in those numbers and that does not seem to happen. This challenges the decision of the Fed to pause hikes.

The U.S. oil inventories change figure was reported negative and in fact way lower than the previous change, -3.8M.

General Verdict:

______________________________________________________________________

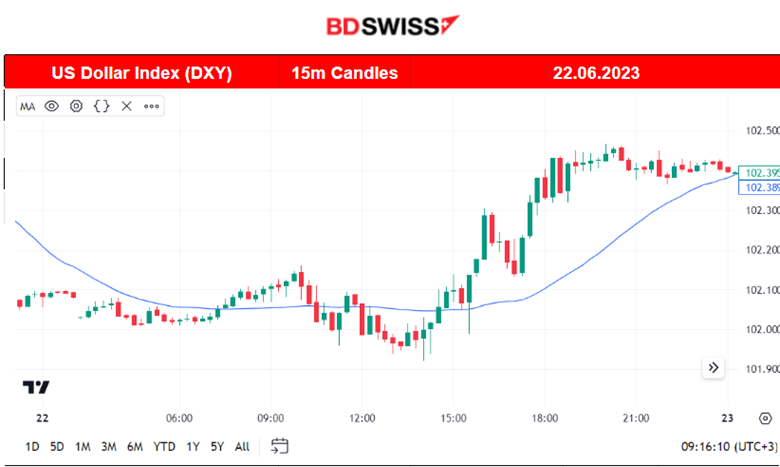

FOREX MARKETS MONITOR

GBPUSD (22.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced a shock at the time of the BOE rate decision release but the market reacted with the up-and-down pattern. No clear direction at the time of the release. The pair eventually moved downwards with quite a surprise since one could expect strong GBP appreciation instead after the news. The pair found resistance near 1.27240 and then reversed to the mean, going sideways with lower volatility.

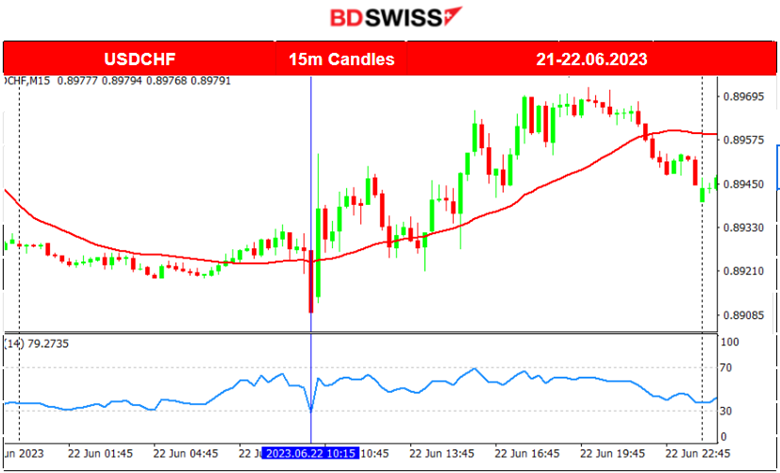

USDCHF (22.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was affected by the SNB rate decision at 10:30. Policymakers decided to increase rates to 1.75% and that caused a shock. The pair dropped rapidly but reversed almost immediately. No clear direction at first, instead the up-and-down pattern ruled the market. It eventually remained above the 30-period MA due to the USD driving the market pushing the pair upwards with a steady but volatile pace. Towards the end of the trading day, the pair reversed, crossing the MA and moving downwards.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index surprisingly moved higher yesterday. The price experienced a reversal since it moved rapidly upwards crossing the 30-period MA. This week, the index was following a downward short-term trend since it retraced from the recent long movement upwards. It was not clear whether a sideways or a downward movement had started. Now it is more clear that the market is just steadily trying to resist falls, experiencing high volatility. After the reversal, I am expecting retracement back to the MA.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was moving sideways around the mean but with high volatility. Price broke the significant support yesterday at 69.85 USD//b and moved further downwards to the next support at nearly 69.00 USD/b. Crude oil inventories figures were released at 18:00 and showed that the previous week there were way fewer barrels in store. However, it was a strong reversal and retracement back to the mean will probably follow.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold moves lower and lower. A downward trend is visible, support levels are broken every day almost. Yesterday Gold moved also lower finding support at 1910 USD.

______________________________________________________________

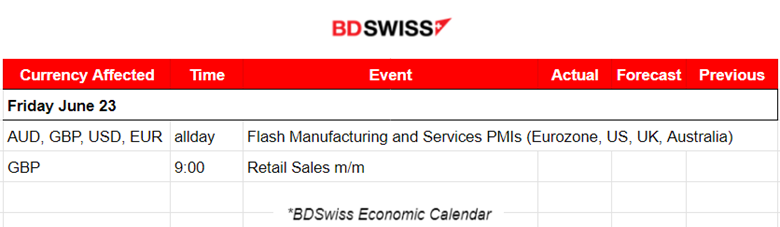

News Reports Monitor – Today Trading Day (22 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

Today we have PMI releases that might have an impact. Usually, we do not see any shocks but rather a steady movement in one direction. High deviations from the mean are possible, especially during the European session. At the exact time of the PMI release, we might see some shocks and high deviations from the mean.

U.K. retail sales volumes are estimated to have risen by 0.3% in May 2023. The monthly figure was released at 9:00. Spending is on. High prices on. We know already that BOE aggressively hiked.

General Verdict:

______________________________________________________________