The Cape Town Art Fair 2024, commencing today, Friday February, 16, and concluding on Sunday, 18 February 2024, offers hope for job creation. This potential increase in employment could positively influence the anticipated rise in South Africa’s unemployment rate figure expected to be released on 20 February 2024.

Source : https://www.yomzansi.com/2023/02/01/investec-cape-town-art-fair-2023/

South Africa’s quarterly unemployment rate report is scheduled for release on February 20, 2024, at 09:30 GMT. This report indicates the percentage of the workforce actively seeking employment. If the actual figure is lower than the forecast, it’s favourable for the South African Rand (ZAR).

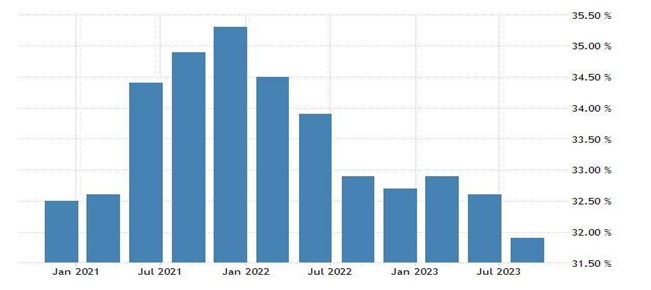

In recent data, South Africa’s unemployment rate decreased to 31.90% as of November 14, 2023, down from 32.60% in the previous quarter (August 15, 2023). Analysts predict it to reach 32.70% by the end of the current quarter, as per Trading Economics’ models.

Unemployment growth can weaken a nation’s currency due to reduced spending, lower tax income, and increased government expenses on benefits.

Source : https://tradingeconomics.com/south-africa/unemployment-rate

Source : https://tradingeconomics.com/south-africa/unemployment-rate

Looking at the USDZAR pair on a daily basis, it’s been trending upward since July 27, 2023. An uptrend line drawn from that date, initially at 17.42404 ZAR per USD, resisted the price when it reached 18.10709 ZAR, even though it could have reached the previous high of 19.91697 ZAR. After this rejection, the price has met resistance around 19.19124 ZAR, currently the pair hold at approximately 18.95 ZAR. If the current price rejection holds, there’s a likelihood of a downward movement. However, if it reaches the trendline and is rejected again, it may move back to resistance. A break of the trendline would suggest further downward movement.

Source : Daily USDZAR Chart from Metatrader 4

In the hourly timeframe, USDZAR is observed in an uptrend. A trendline from 18.55275 ZAR rejected the price at 18.79454 ZAR, moving higher and being rejected at 19.18765 ZAR, currently around 18.96211 ZAR heading towards the trendline. A rejection at the trendline suggests upward movement to the current resistance of 19.18765 ZAR, while a break of the trendline may result in further downward movement.

Source : 1HR USDZAR Chart from Metatrader 4