Apple’s Q3 FY24 earnings call to review financial performance and business developments is set for today, Thursday August 1, 2024, at 2:00 p.m. PT / 5:00 p.m. ET.

Market Cap

€3.098 trillion market cap positions Apple as the leading entity in global equity markets, marking it as the foremost valuable corporation worldwide, as per companiesmarketcap.com data for July 2024.

Dividend Information

This stock presents a quarterly dividend yield of 0.46% and an annual dividend of $1.00, with an ex-dividend date on May 10, 2024. It maintains a sustainable payout ratio of 15.55% and has achieved consistent dividend growth of 4.30% over 12 years. The stock also features a buyback yield of 2.41% and a shareholder yield of 2.87%.

Recent Development At Apple

Here are the most recent updates from Apple.

– Apple Maps beta version is now available on the web.

– Apple earns a record 72 Emmy nominations, dominating major categories.

– Apple releases the HomePod mini in a new midnight color.

– Apple Arcade added three new games in August, including Temple Run: Legends and Vampire Survivors+.

– Apple Vision Pro launches in mainland China, Hong Kong, Japan, and Singapore.

Q2 Earnings Report Recap

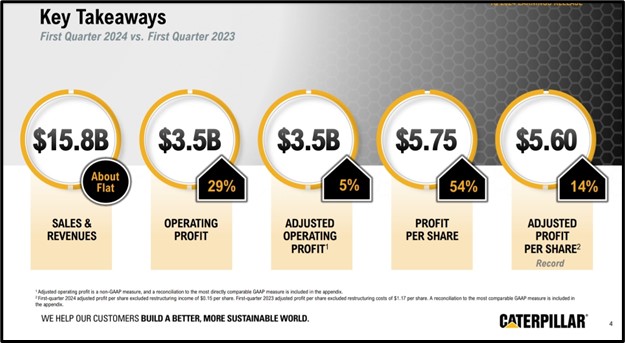

Revenue Breakdown: Apple reported total net sales of $90.753 billion for Q1 2024, with $66.886 billion from products and $23.867 billion from services.

Cost of Goods Sold (COGS): The cost of sales amounted to $48.482 billion, leading to a gross margin of $42.271 billion.

Operating Expenses: The company incurred $14.371 billion in operating expenses, including R&D and SG&A costs.

Earnings Performance: Net income for the quarter was $23.636 billion, resulting in an EPS of $1.53, both basic and diluted.

Segment Performance: Strong sales across regions, with the Americas contributing $37.273 billion and Greater China at $16.372 billion, highlighting robust international demand.

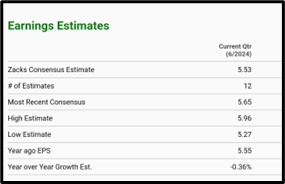

Q3 Earnings Report Analyst Forecast

For the current quarter, Zacks Consensus projects sales of $84.43B, with estimates ranging from $82.92B to $86.68B, marking a 3.22% year-over-year increase from $81.80B. Earnings per share (EPS) are forecasted at $1.34, with a consensus of $1.36, ranging from $1.28 to $1.39, reflecting a 6.35% year-over-year growth from $1.26.

According to Investing.com, Apple (NASDAQ: AAPL) is projected to report an EPS of $1.35 and revenue of $84.45 billion.

According to TradingView.com, Apple’s (NASDAQ: AAPL) EPS forecast is $1.34, while revenue is projected at $84.43 billion.

Technical Analysis

– Apple’s uptrend line rejection at $216.89 observed.

– If rejection holds, potential move to $231.98; break of $231.98 could target $251.17.

– If rejection fails, downside risk to $205.03; break of $205.03 could extend to $195.71.

Apply Risk Management

Conclusion

Apple’s consistent performance, highlighted by its substantial market cap of €3.098 trillion and steady dividend growth, underscores its leading position in global equity markets. The Q2 FY24 results demonstrated robust revenue of $90.753 billion and solid earnings, while the current forecast for Q3 indicates a potential rise in sales to $84.43 billion and EPS growth to $1.34. Recent developments and a strategic focus on new technologies further support a positive outlook. However, technical analysis suggests volatility, with potential price movements contingent on trendline rejections. Continued monitoring of these factors will be crucial for assessing future performance.

Source:

https://investor.apple.com/investor-relations/default.aspx

https://companiesmarketcap.com/eur/apple/marketcap/#google_vignette

https://stockanalysis.com/stocks/aapl/dividend/

https://images.app.goo.gl/fY1XvbGDjqFNVMUK6

https://www.apple.com/newsroom/2024/07/apple-maps-on-the-web-launches-in-beta/

https://www.apple.com/newsroom/2024/07/apple-introduces-homepod-mini-in-midnight/

https://www.zacks.com/stock/quote/AAPL/detailed-earning-estimates

https://www.investing.com/equities/apple-computer-inc-earnings