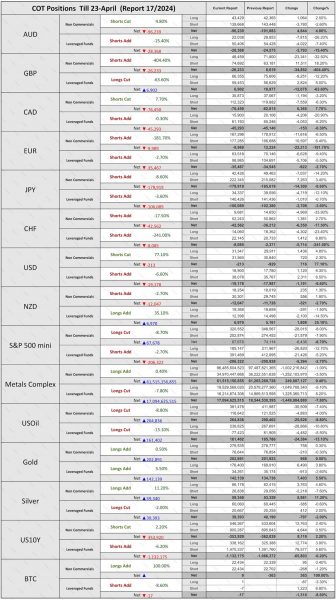

Latest Commitments of Traders (COT) report, April 23, 2024 (17th report of the year) the cut-off date.

COT Dashboard (Non Commercials)  The below currencies saw an addition or cut in the non-commercials.

The below currencies saw an addition or cut in the non-commercials.

-

- EUR: Net positions in EUR turned into shorts (9,989 contracts / 181.7%), previously long with 12,224 contracts. This marks the first time EUR has seen shorts since September 2022.

- JPY: Short positions (8.6%) in JPY were added, marking the largest since mid-2007.

- GBP: The GBP observed its first short position (26,233 / 404.4%) contracts since November 2023, having been long with 8,619 contracts earlier.

- CHF: 17.5% short positions added,this is the biggest short since 2018.

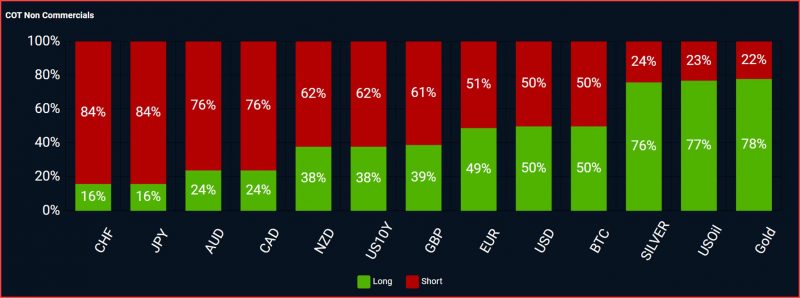

Below is the stacked barchart for the Non Commercia

- Commodities have net long positions

- USD, EUR, and GBP are on the mixed side

- Antipodeans and US10Y are leaning towards the shorts side

Sources:

https://www.cftc.gov/MarketReports/CommitmentsofTraders/HistoricalCompressed/index.htm

Forex Source