Q2 FY24 Adobe Earnings Conference Call will take place today, Thursday, June 13, 2024, at 2:00 pm PT.

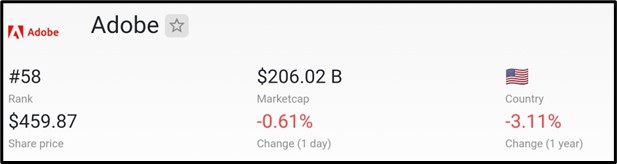

Market cap for Adobe is $206.02 billion as of June 2024, making it the 58th most valuable company in the world according to companiesmarketcap.com.

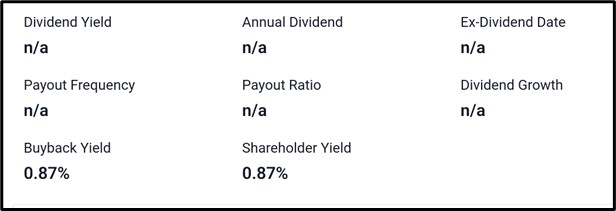

Dividend Information

Dividend yield, annual dividend, ex-dividend date, payout frequency, payout ratio, and dividend growth are all not applicable. However, the buyback yield is 0.87%, giving a total shareholder yield of 0.87%.

Recent Development At Adobe

Below are the latest developments at Adobe:

“Design Made Easy” Event: Showcased how leading companies are enhancing design across teams.

Adobe Experience Platform AI Assistant: Announced general availability to boost enterprise productivity.

New Adobe Express for Enterprise: Facilitates on-brand content creation and production across teams.

Firefly-Powered Generative Remove in Lightroom: Introduced for fast and easy AI-editing.

Acrobat AI Assistant: Launched to revolutionize workplace productivity for enterprises.

Q1 FY24 Adobe Earnings Report Reca

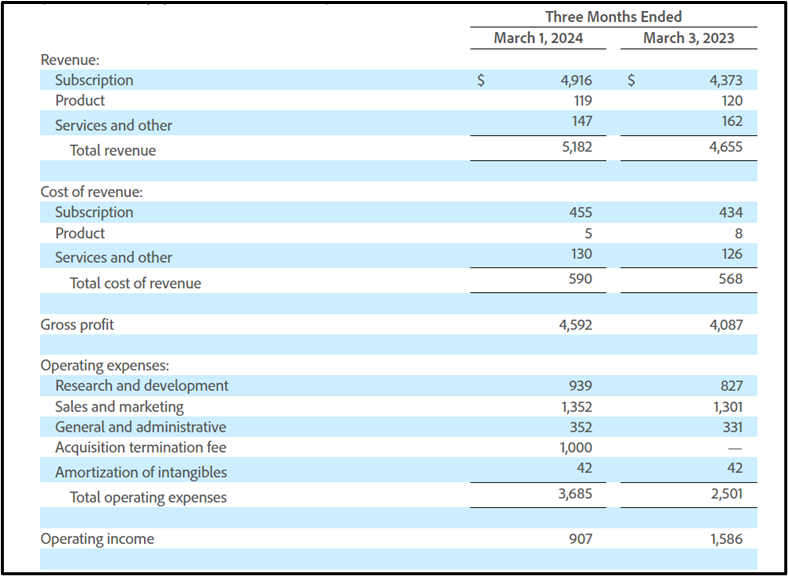

Adobe’s financial report for the first quarter of fiscal year 2024 shows strong performance:

– Revenue reached $5.18 billion, up 11% from last year.

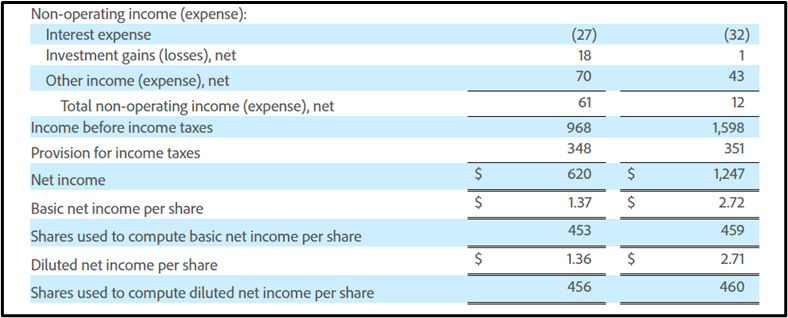

– Diluted earnings per share were $1.36 on GAAP basis and $4.48 on non-GAAP basis.

– GAAP operating income was $907 million; non-GAAP operating income was $2.47 billion.

– GAAP net income was $620 million; non-GAAP net income was $2.05 billion.

– Cash flows from operations totaled $1.17 billion.

– Remaining Performance Obligations (RPO) were $17.58 billion.

– Adobe repurchased about 3.1 million shares.

Business segment highlights:

– Digital Media segment revenue was $3.82 billion, with Creative revenue at $3.07 billion and Document Cloud revenue at $750 million.

– Net new Digital Media Annualized Recurring Revenue (ARR) was $432 million, totaling $15.76 billion.

– Digital Experience segment revenue was $1.29 billion, with subscription revenue at $1.16 billion.

Adobe’s CEO, Shantanu Narayen, noted record Q1 revenue driven by strong growth in Creative Cloud, Document Cloud, and Experience Cloud. CFO Dan Durn highlighted strong customer adoption and announced a new $25 billion share repurchase program.

Adobe’s Q2 FY24 Forecast

Adobe’s Forecast

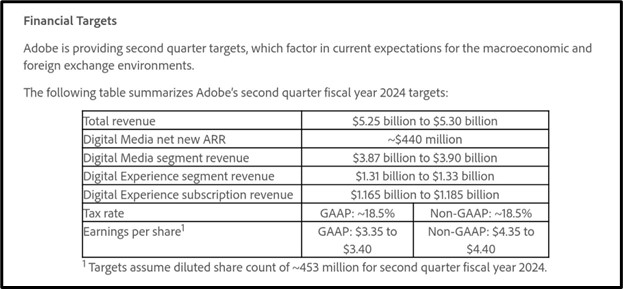

Here are Adobe’s projections for the second quarter of fiscal year 2024, taking into account economic and currency conditions:

– Expected total revenue: Between $5.25 billion and $5.30 billion

– Anticipated Digital Media net new Annualized Recurring Revenue (ARR): Approximately $440 million

– Projected Digital Media segment revenue: $3.87 billion to $3.90 billion

– Estimated Digital Experience segment revenue: $1.31 billion to $1.33 billion

– Projected Digital Experience subscription revenue: $1.165 billion to $1.185 billion

– Expected tax rates:

– GAAP: Around 18.5%

– Non-GAAP: Around 18.5%

– Forecasted earnings per share:

– GAAP: $3.35 to $3.40

– Non-GAAP: $4.35 to $4.40

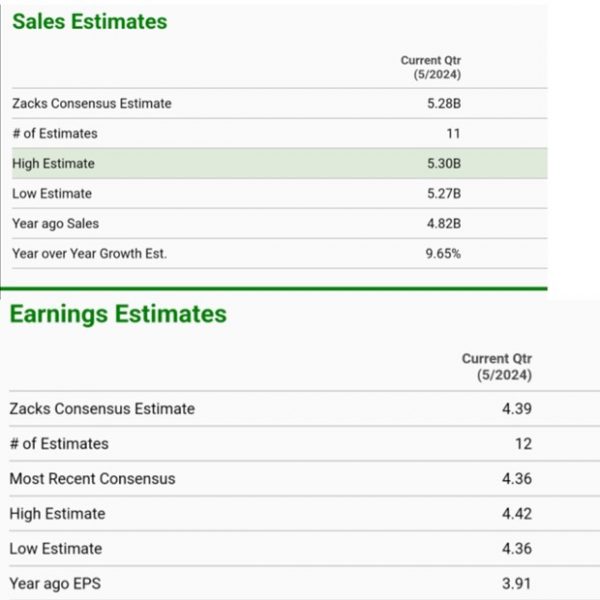

Zack’s Forecast

For the upcoming quarter, analysts predict Adobe’s sales to range between $5.27 billion and $5.30 billion, with a consensus estimate at approximately $5.28 billion, marking a growth of about 9.65% from last year’s $4.82 billion. In terms of earnings per share (EPS), expectations are around $4.36 to $4.42, with a consensus estimate of $4.39 among 12 analysts. This represents a projected EPS growth of approximately 12.28% compared to $3.91 a year ago.

Investing.Com’s Forecast

Investing.com predicts that Adobe Systems Incorporated (NASDAQ: ADBE) will earn $4.34 per share and expects revenue to reach $5.29 billion.

Tradingview.com’s Forecast

As per Tradingview.com, Adobe Systems Incorporated (NASDAQ: ADBE) is expected to report earnings per share (EPS) of $4.39 and achieve revenue of $5.29 billion.

Technical Analysis

– Support rejection observed at $432.44 on Adobe’s 4-hour chart (NASDAQ: ADBE) on Tradingview.

– If rejection holds:

Potential upside target: $476.82.

Break above $476.82 could lead to further upside to $511.67.

Further breakout above $511.67 suggests potential for continued upward movement.

– Alternatively, if rejection fails:

Downside target: $376.03.

Break below $376.03 may lead to further decline towards $304.27.

Apply Risk Management

Conclusion

In conclusion, Adobe’s performance in Q1 FY24 demonstrated robust growth with record revenue and strong financial metrics across its business segments. The company’s strategic initiatives, such as the introduction of innovative AI-powered tools and enhancements in digital experience platforms, underscore its commitment to driving productivity and expanding market reach. Looking ahead to Q2 FY24, Adobe’s forecasted revenue and earnings per share reflect optimistic projections amidst favorable economic conditions. However, technical analysis highlights potential price movements based on support levels, emphasizing the importance of risk management in navigating market fluctuations and maximizing shareholder value.

Sources :

https://event.webcasts.com/starthere.jsp?ei=1670425&tp_key=cc41e5822e&tp_special=8

https://companiesmarketcap.com/adobe/marketcap/

https://www.adobe.com/investor-relations/faq.html#:~:text=Adobe%20does%20not%20pay%20a%20dividend.

https://stockanalysis.com/stocks/adbe/dividend/

https://images.app.goo.gl/mA1CCfWRbR4dKAhy6

https://www.zacks.com/stock/quote/ADBE/detailed-earning-estimates

https://www.investing.com/equities/adobe-sys-inc-financial-summary

BDSwiss Academy Page on Tradingview