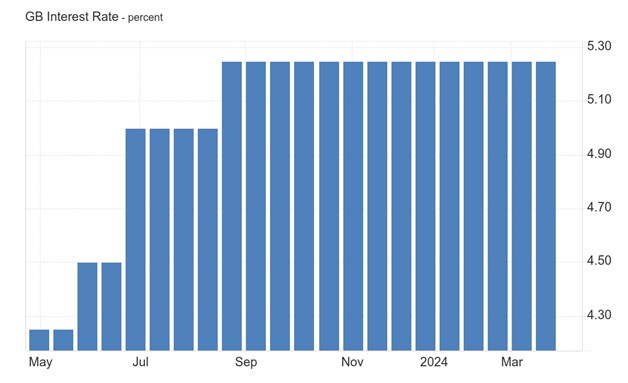

In the United Kingdom on Thursday 21 March 2024, significant reports were unveiled. While the PHSO ( Parliamentary and Health Service Ombudsman ) concluded its investigation into the state pension age for women, revealing years of upheaval due to changes introduced in the 1995 Pensions Act, the Bank of England announced its decision to maintain the Bank Rate at 5.25% during its March meeting. The state pension age, previously set at 60, underwent revisions to 65 by November 2018 and 66 by October 2020, triggering chaos among affected women. The government’s failure to notify them for nearly 14 years post-enactment of the law further exacerbated the situation, prompting advocacy efforts by groups like the Women Against State Pension Inequality (Waspi), formed in 2015. Following a prolonged investigation, the PHSO found the DWP culpable of maladministration, particularly regarding actions dating back to 2005 and 2006. Meanwhile, the Bank of England’s decision to maintain the Bank Rate, its highest level since 2008, reflected policymakers’ cautious approach amid lingering inflationary pressures.

During its March meeting, the Bank of England maintained the Bank Rate at 5.25%, its highest level since 2008. The Monetary Policy Committee voted 8-1 in favor of the unchanged rates, with one member advocating for a 25 basis point decrease. This decision was contrary to market expectations, which anticipated a slightly more hawkish 7-2 vote, with one member advocating for the cut and another for a hike. The announcement followed the revelation that the country’s CPI rate had dropped to 3.4%, its lowest level in almost two-and-a-half years. Governor Bailey expressed optimism about Britain’s economic outlook, hinting at the potential for interest rate reduction but emphasized the need for greater certainty regarding the economy’s ability to manage price pressures.

In the United Kingdom, the benchmark interest rate is set by the Monetary Policy Committee (MPC), with the Bank of England’s official interest rate being the repo rate. This repo rate applies to open market operations involving a group of counterparties, including banks, building societies, and securities firms.

From a trading perspective using the Daily Chart of GBPUSD, it’s evident that GBPUSD maintained an uptrend from October 26, 2023, until yesterday when the uptrend line was breached downward following the release of the unchanged BOE Official Bank Rate at 5.25%.

An uptrend line originating from the exchange rate of 1.20665 rejected the exchange rate at 1.25980 after a retracement from 1.28274. Subsequently, the exchange rate continued its uptrend, reaching 1.28941 before reversing direction towards the trend line in a downward trajectory. The breach of the uptrend line occurred yesterday following the release of the BOE Official Bank Rate, causing the exchange rate to fall below the trend line, currently hovering around 1.26966.

If the current breach of the uptrend line persists, there is a high probability of further downward movement in the exchange rate. However, if the exchange rate reverses and breaks the uptrend line upward, there is a significant likelihood of further upward momentum in price.

Sources :

https://www.legislation.gov.uk/ukpga/1995/26/contents/enacted

https://www.independent.co.uk/topic/parliamentary-and-health-service-ombudsman

https://publications.parliament.uk/pa/cm5804/cmselect/cmpubadm/198/report.html