Today in Australia, amidst political turmoil as Labor’s deportation bill failed to pass the Senate, an unexpected alliance formed between the Coalition and Greens. Despite voting alongside the government in the lower house, the Opposition called for a “proper inquiry” to mitigate potential “unintended consequences.”

Simultaneously, at 00:30 GMT, the Australian Bureau of Statistics unveiled the Consumer Price Index (CPI), which gauges monthly shifts in the prices of goods and services. This figure fell slightly below the anticipated forecast of 3.6%. by the BDSwiss economic calendar.

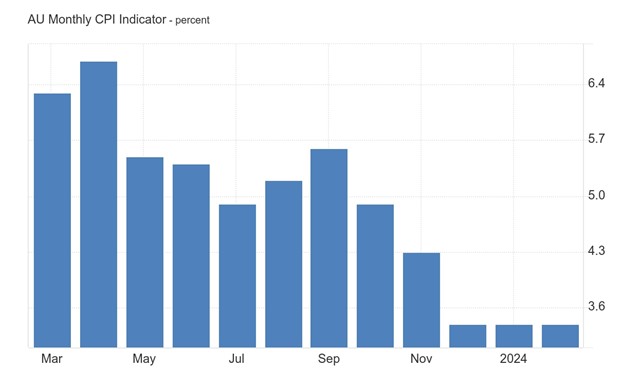

The monthly Consumer Price Index (CPI) indicator in Australia stood at 3.4% in the year to February 2024, unchanged from the previous two months and below market expectations of 3.6%. Still, the latest reading pointed to the lowest since November 2021, with food prices rising the least in 25 months (3.6% vs 4.4% in January). Also, prices moderated for alcohol and tobacco (6.1% vs 6.7%) and communications (1.7% vs 2.0%) while declining for furnishings, household equipment & services (-0.3% vs 0.3%). Meanwhile, inflation was steady for housing (at 4.6%) and health (at 3.9%). On the other hand, prices accelerated for transport (3.4% vs 3.0%), education (5.1% vs 4.7%), and clothing and footwear (0.8% vs 0.4%), while those of recreation and culture rebounded (0.4% vs -1.7%). The monthly CPI indicator excluding volatile items and travel advanced by 3.9% in February, down from a 4.1% rise in January. Inflation remains outside the RBA’s target range of 2-3%.

From a technical analysis standpoint, observing the 1-hour chart of AUDUSD, the exchange rate has exhibited a downtrend pattern, originating from 0.65590 and presently hovering around 0.65279.

A downtrend line, drawn from the peak at 0.65590, acted as resistance, rejecting the exchange rate at 0.65386, forming a lower high subsequent to retracing from 0.65303. Following this rejection, the exchange rate continued its descent within the downtrend, reaching 0.65112, which currently serves as the support level, until initiating a rebound, currently resting around 0.65279.

Should the exchange rate breach the downtrend line upwards, it would signal a potential continuation of the upward movement. Conversely, if the support level is breached, there is a likelihood of the exchange rate declining further.

Sources :

https://global.bdswiss.com/economic-calendar/

1HR Chart of AUDUSD from Metatrader 4