On Easter Sunday, the 31st of March 2024, as Christians celebrated the resurrection of Jesus, Turkey’s opposition scored a remarkable victory in various major cities during the country’s local elections. This outcome dealt a significant blow to President Recep Tayyip Erdogan’s ruling party.

As the world absorbed the news of Turkey’s political shift, on the 1st of April 2024, the USD ISM Manufacturing PMI figure surprised markets by coming in strong at 50.3, surpassing the forecasted 48.3 by BDSwiss economic calendar. This unexpected positive news propelled XAUUSD to an unprecedented all-time high price of $2265.57 per ounce. Despite the coincidence of this milestone occurring on April Fool’s Day, it was indeed a momentous event.

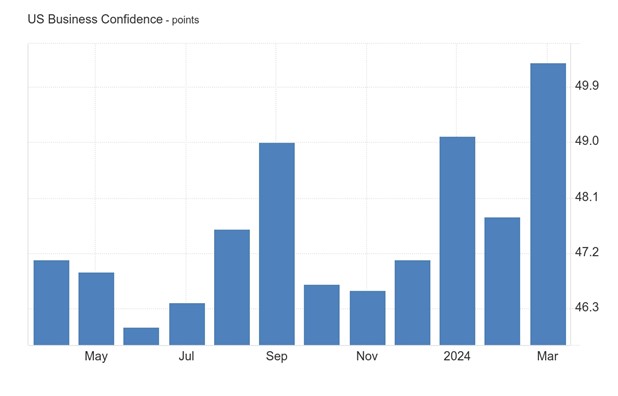

In March 2024, the ISM Manufacturing PMI in the United States went up to 50.3, rising from 47.8 in February 2024. It beat the expected 48.4, showing the first growth in the manufacturing sector after 16 months of shrinkage. There were good signs in demand, like the new orders Index reaching 51.4 (compared to 49.2 before), and the new export orders Index staying steady at 51.6. However, backlogs stayed in a moderate contraction at 46.3. Companies surveyed increased their production levels notably to 54.6, but employment numbers kept dropping to 47.4. Prices also continued to go up moderately to 55.8, mainly because of unstable commodity costs.

This report collects information from purchasing and supply executives all over the country.

XAUUSD surged to an all-time high of $2,265.57 an ounce on Monday, April 1, 2024, marking a significant 1.6% increase from Thursday’s closing price. However, its gains were later trimmed as traders reconsidered the Federal Reserve’s stance on interest rate cuts, especially after robust US factory data was released.

The Fed’s favored measure of underlying inflation, the core personal consumption expenditures index, showed a cooling trend in February, registering at 0.3%. This data was unveiled on Friday, March 29, 2024, when many markets were closed. Subsequently, gold’s upward momentum was dampened by Monday’s US manufacturing data, which intensified the debate over the number of interest rate cuts the Fed might implement this year.

The ISM Manufacturing PMI revealed the first expansion in the manufacturing sector in 18 months, accompanied by increased price pressures. This prompted investors to reassess their expectations regarding the timing of the first Fed rate reduction.

The new trading week and month in Europe, following the Easter break, has seen the bid on Gold maintained as a new all time high has been posted today (Tuesday, April 2) as the price moved to $2,267.00, before cooling to $2256.00, at time of writing.

From a technical analysis perspective, the XAUUSD price has exhibited an upward trend, originating from $2191.18 and presently hovering around $2256.00.

A trendline drawn from $2191.18 acted as resistance, rejecting the price at $2228.24 after retracing from the all-time high price of $2267.00, which currently serves as the resistance level.

Following the rejection by the uptrend line, the price continued its upward movement, currently resting around $2256.00.

If the uptrend line is breached, there is a higher likelihood of the price declining further. Conversely, if the uptrend line continues to reject the price, there is a higher probability of the price rising towards the resistance level. Breaking the resistance level would suggest an increased likelihood of further upward movement in prices.

Sources

https://global.bdswiss.com/economic-calendar/

Daily Chart & H1 Chart of XAUUSD from Metatrader 4