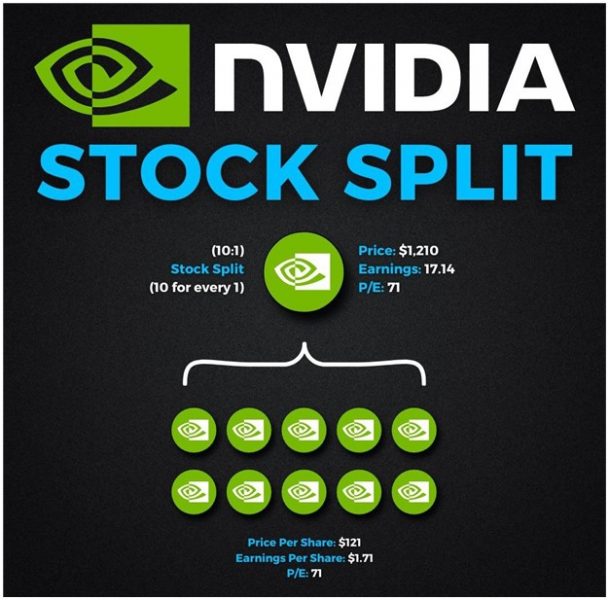

A stock split is a corporate action where a company increases the number of its outstanding shares by issuing more shares to current shareholders. This process divides the existing shares into multiple new shares while maintaining the overall value of the investment. Companies often perform stock splits to make their shares more affordable and attractive to investors, thereby enhancing liquidity and broadening the investor base.

Nvidia’s Recent Stock Split

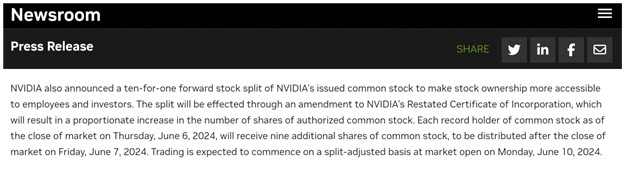

Nvidia (NVDA) completed a ten-for-one stock split after the market closed on Friday, June 7, 2024. This move was first announced as part of its first-quarter financial results released on May 22, 2024. Nvidia’s Q1 FY25 results detailed the ten-for-one forward stock split, aimed at making stock ownership more accessible to employees and investors. This was achieved by amending Nvidia’s Restated Certificate of Incorporation, resulting in a proportionate increase in the number of shares of authorized common stock.

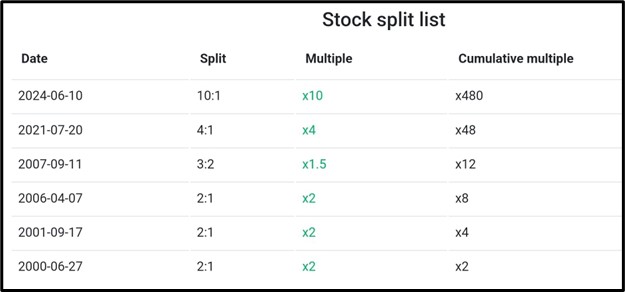

Historical Context of Nvidia’s Stock Splits

The stock split on June 7, 2024, marks the sixth such event in Nvidia’s history since it went public in January 1999. Nvidia’s earlier splits include three two-for-one splits in 2000, 2001, and 2006; a three-for-two split in 2007; and a four-for-one split in 2021. The recent ten-for-one split is the most significant in terms of the number of additional shares issued to shareholders.

Benefits for Investors

The primary advantage of a stock split is that it makes the stock more affordable for potential investors. By lowering the price per share, more individuals can purchase the stock, potentially increasing market participation and liquidity. Before the split, Nvidia’s stock price was $1,208.88. Post-split, it adjusted to $120.88, reflecting the ten-for-one division. This reduced price makes it easier for smaller investors to buy shares, promoting broader ownership.

Market Reaction and Expectations

On Monday, June 10, 2024, Nvidia began trading on a split-adjusted basis. Each shareholder of record as of June 6, 2024, received nine additional shares for every share they held. The stock price adjusted to $120.88, and the market showed little volatility at the opening.

Wall Street analysts maintain an optimistic outlook for Nvidia, though there are concerns about its high valuation. Currently, the stock holds a ‘moderate buy’ rating from 43 analysts surveyed by MarketBeat. Among them, 38 rate it as a ‘buy,’ one as a ‘strong buy,’ and four as a ‘hold.’ Despite a consensus view suggesting a potential downside of around 6.51% from the pre-split price, the split itself is generally seen as a positive move to attract more investors.

Technical Analysis

In the 4-hour chart of NASDAQ: NVDA, technical analysis indicates an uptrend following the breakout above the initial resistance at $97.38, which has now become support. The price advanced to the current resistance at $125.50 and has pulled back to around $121.65. A potential resistance breakout at $125.50 could propel the price to $133.11, and further to $142.79 if $133.11 is breached. Conversely, if the breakout fails, the price may decline to $119.58, with a further drop to $114.79 if $119.58 is broken.

Conclusion

Nvidia’s ten-for-one stock split demonstrates a strategic effort to make its shares more accessible and to enhance market liquidity. While the split adjusts the share price, it does not change the company’s overall valuation. By understanding the rationale and impact of stock splits, investors can make more informed decisions about their investments in companies like Nvidia.

Sources

https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-first-quarter-fiscal-2025

https://companiesmarketcap.com/nvidia/stock-splits/

https://www.marketbeat.com/stocks/NASDAQ/NVDA/forecast/

https://x.com/carbonfinancex/status/1799091303331852325?t=rh6QqrKH2EVoHnSr4Lz4Wg&s=19