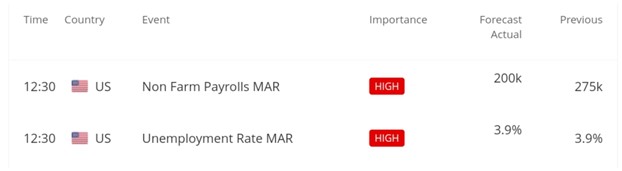

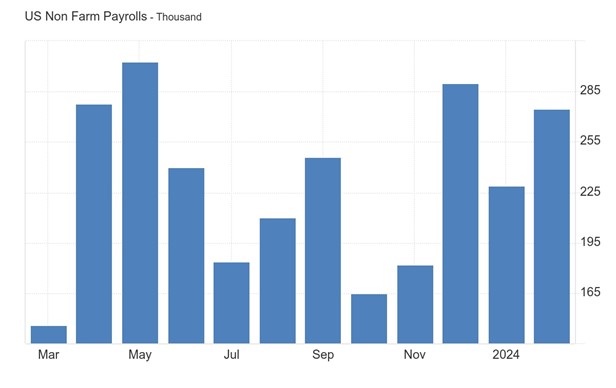

The US WTI Crude, a key benchmark, surged to nearly $86.698 amid reports of threats against the Israeli embassy. This rise extends its winning streak since March 27, fueled by escalating geopolitical tensions and the looming threat of oil supply disruptions. Meanwhile, today around 13:30 GMT, the US non-farm payroll figure, indicating changes in employment excluding farming, is expected to be released with a forecast of 200K compared to the previous 275K, as per the BDSwiss economic calendar.

In March 2024, the US economy is projected to add 200,000 jobs, marking a decrease from the 275,000 added in February and the lowest figure in four months. Despite this decline, employment gains are expected to exceed the 70,000 to 100,000 needed monthly to accommodate the growing working-age population. The unemployment rate is anticipated to remain steady at 3.9%, maintaining its two-year high. Additionally, wages are expected to increase by 0.3%, surpassing February’s 0.1% gain, which was the smallest in two years. This uptick in wages would result in a slight decrease in the annual change to 4.1%, the lowest since June 2021.

Analyzing the 1-hour chart of EURUSD from a technical perspective, we observe an upward trend in the exchange rate.

Initially, an uptrend line drawn from 1.07242 rejected the exchange rate at 1.07639 after retracing from 1.07784. Subsequently, the exchange rate resumed its upward trajectory, reaching 1.08758, which now acts as resistance. However, it retraced to the uptrend line and faced rejection, currently hovering around 1.08320.

Should the current rejection by the uptrend line persist, there’s a high probability of the exchange rate ascending towards the current resistance level. Breaking through this resistance could lead to further upward momentum. Conversely, if the uptrend line fails to hold and breaks downward, the exchange rate may decline further.

Sources:

Daily Chart of USOIL from Metatrader 4

https://global.bdswiss.com/economic-calendar/

https://www.fxstreet.com/markets/commodities/energy/oil

1HR Chart of EURUSD from Metatrader 4